Canton: The Institutional Blockchain

Nov 24, 2025

Canton is a privacy-enabled interoperable Layer 1 blockchain designed specifically for regulated and compliant real-world assets. It is designed to merge the transparency of public networks with bespoke privacy controls in order to support the operations of TradFi and crypto-native enterprises who require these traits.

It is a network that emphasizes privacy, interoperability, scalability and compliance rather than the more typical approach of being a public L1 focused on open, retail-level DeFi first.

Overview of Canton Network

Architecture

From an infrastructural perspective, Canton can be seen as a network of networks in which multiple layers of subnetworks with different operations interoperate. This design approach makes Canton more modular than traditional and monolithic networks, by operating as a decentralized network of networks using modular subnets connected by Sync Domains and coordinated via the Global Synchronizer.

Subnets

These are independent, permissioned environments (called Sync Domains) where participant nodes—run by institutions—execute smart contracts using Daml. Each subnet defines its own privacy, governance, and scaling rules, ensuring sensitive data (e.g., trade details) is visible only to authorized parties. Transactions within a single subnet are processed locally and privately by validator nodes—no global broadcast needed.

Interoperability: Sync Domains & Global Synchronizer

Sync Domains act as decentralized communication hubs that enable secure and encrypted message interaction between subnets when cross-network interaction is required.

The Global Synchronizer, operated by Super Validators (31 trusted institutions as of 2025), ensures:

Finality for cross-subnet transactions (atomic settlement, no double-spending).

Global event ordering with consistent timestamps.

Network-wide governance (⅔ consensus required for protocol changes)

DAML

Canton uses a proprietary and specialized language for defining rights, obligations, and multi-party workflows, enabling complex and atomic transactions via smart contracts. Thanks to this, smart contracts on the network can be tailored with predefined conditions, permissions for involved parties, visibility, and logic through which multiple parties can settle instantly across apps without requiring bridges or intermediaries.

Why It Works for Finance

Privacy by default: Only relevant parties see transaction details.

Scalability: Subnets run in parallel; capacity grows with adoption.

Interoperability without bridges: Atomic, real-time settlement across assets and domains.

Regulatory alignment: Permissioned access, auditability, and institutional-grade security.

Canton Coin

Canton Coin (CC) is the network’s native utility token and it serves as the payment asset for network fees and is used to incentivize ecosystem participants. CC aligns incentives for ecosystem participants including validators, users, and developers.

CC operates on a token minting mechanism tied to actual network usage, coupled with a Burn-Mint Equilibrium (BME) mechanism that contributes to Canton’s scarcity. Minting is capped at 2.5 billion CC per year and a conversion rate is employed to adjust the supply based on real-time network demand.

Demand Scenario | Conversion Rate |

Network usage increases | - More fees are inherently burned |

Network usage drops | - Fewer fees will be burned by users, as direct effect |

Canton Coins are minted every 10 minutes and are distributed to Super Validators, Validators and Ecosystem Apps as rewards for activity. The network usage fees are completely burned.

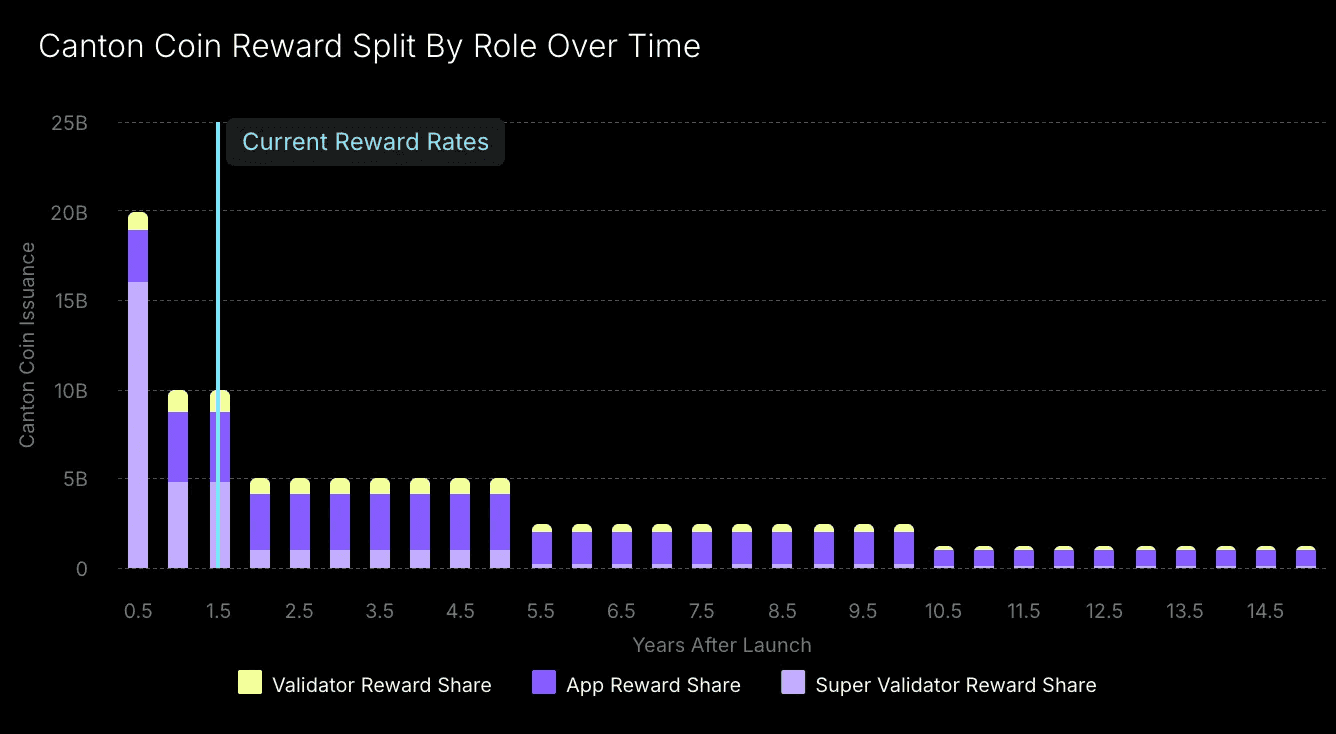

100 billion coins are expected to be minted over the first 10 years, followed by 2.5 billion coins annually. The minting curve shifts allocation over time, rewarding infrastructure providers more at early stages and application developers as time passes by and the network grows.

Years | Coins / Year | Application % | Validators % | Super Validators % |

|---|---|---|---|---|

0–0.5 | 40b | 15% | 5% | 80% |

0.5–1.5 | 20b | 40% | 12% | 48% |

1.5–5 | 10b | 62% | 18% | 20% |

5–10 | 5b | 69% | 21% | 10% |

10+ | 2.5b | 75% | 20% | 5% |

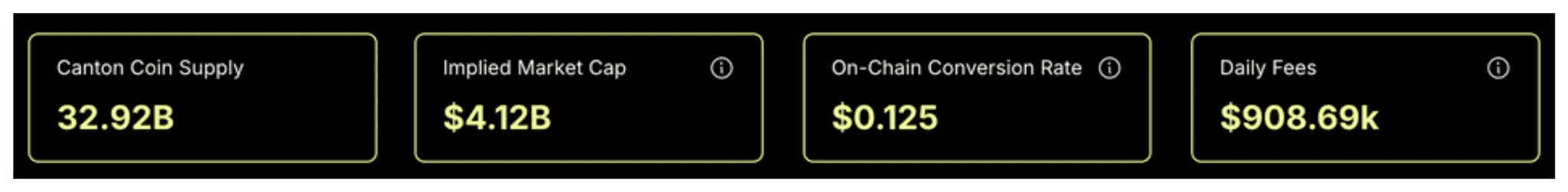

Canton Coin currently has a supply of 32.89 billion

Canton Network Structure

Entity | Type | Description | Key Aspects |

Digital Asset | Parent Company | The founding and primary development entity behind Canton. It created the network, the Daml language, and continues to boost adoption through funding and partnerships | - Founded in 2014 in New York, USA |

Canton Foundation | Governance Non-Profit Entity | An independent governance body ensuring transparent, neutral evolution of the Canton Network | - Founded in 2024 |

Global Synchronizer Foundation | Infrastructure Non-Profit Entity | Foundation focused on the Global Synchronizer, the decentralized hub enabling interoperability across Canton applications and domains | - Tasked to facilitate governance of the Global Synchronizer |

Linux Foundation | Independent Non-profit organization | Non-profit organization established in 2000 to support Linux development and open-source software projects | - Independent entity managing the GSF at launch |

Founding Consortium | Founding alliance of companies | Group that collaborated to develop, test, and deploy the network | Includes over 30 major financial institutions, exchanges, market infrastructure providers, and technology firms |

Canton Network Metrics

Key Volume Metrics

Tokenized Assets Managed: As of October 2025, on-chain tokenized assets (e.g. bonds, Treasuries, RWAs) on Canton surpass $6 trillion in value, exceeding the GDP of most countries and representing a major share of institutional blockchain activity

Repo Trades: Over $4 trillion in monthly U.S. Treasury repo financing which accounts for more than 57.5% of global digital bond issuance

Daily Transaction Volume: Surpassed 600,000 transactions per day by late October 2025, up from 500,000 in September.

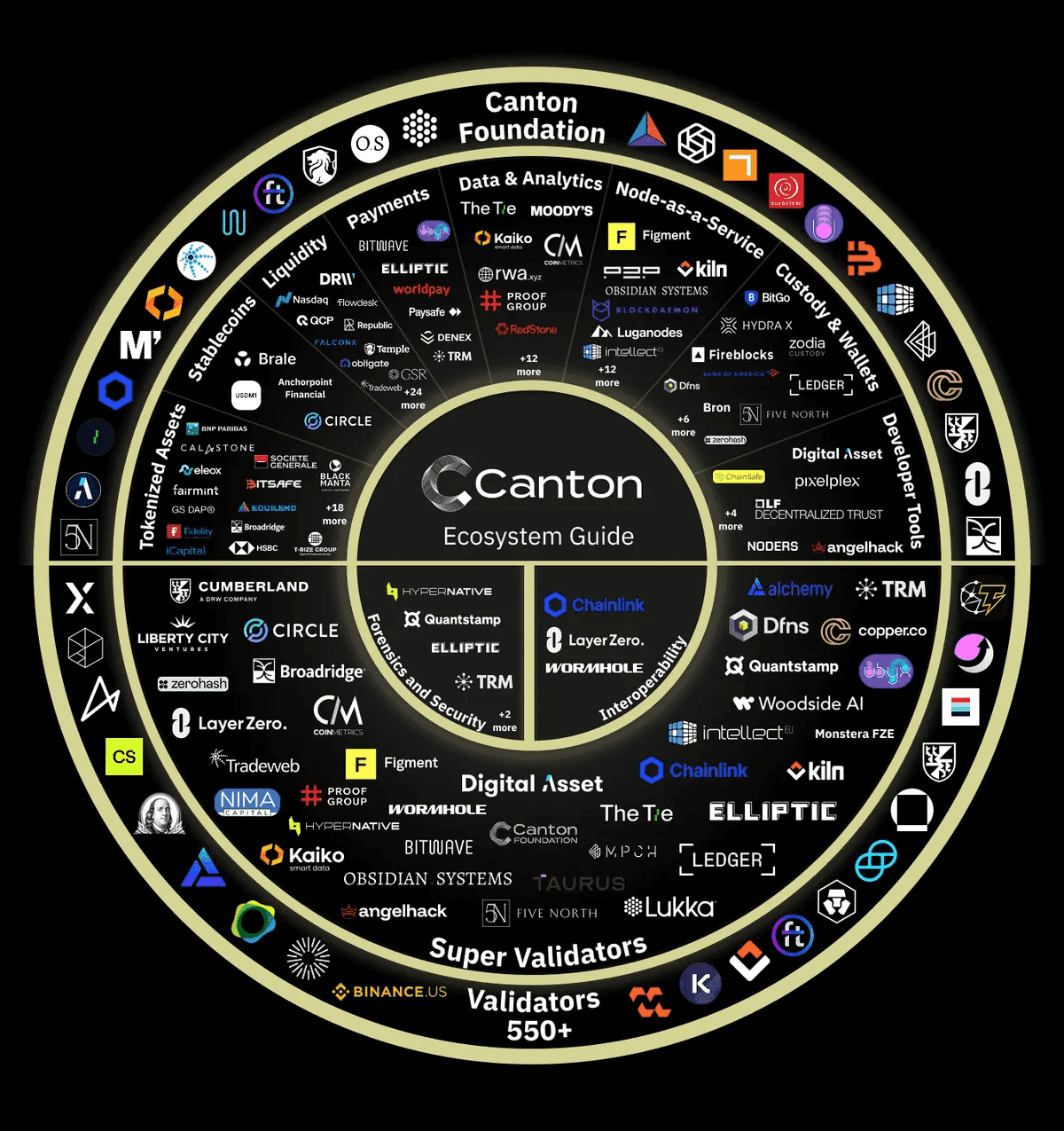

Network Growth: Canton expanded from 24 validators at launch to over 550 validators, 31 Super Validators, and 100 ecosystem apps and service providers.

Canton Coin Rewards

At network inception, the conversion rate was of $0.005 per CC and, as of October 30 of 2025, The Tie's Canton analytics dashboard states the current on-chain conversion rate sits at $0.125 per CC, reflecting significant network growth and utility. The conversion rate increase from $0.005 to $0.125 demonstrates how the system dynamically adjusts to align the token's value with actual usage, rather than speculation since the token is not currently tradable on publicly-accessible exchanges.

The Burn-Mint Equilibrium mechanism and the conversion rate mentioned before are responsible for this change.

The BME system regulated the supply and value, ensuring stability and tying the token's worth directly to network activity

The conversion rate is the on-chain USD/CC exchange rate used specifically for fee calculations and equilibrium adjustments. It is updated every 10 minutes during minting rounds to reflect real-time network demand.

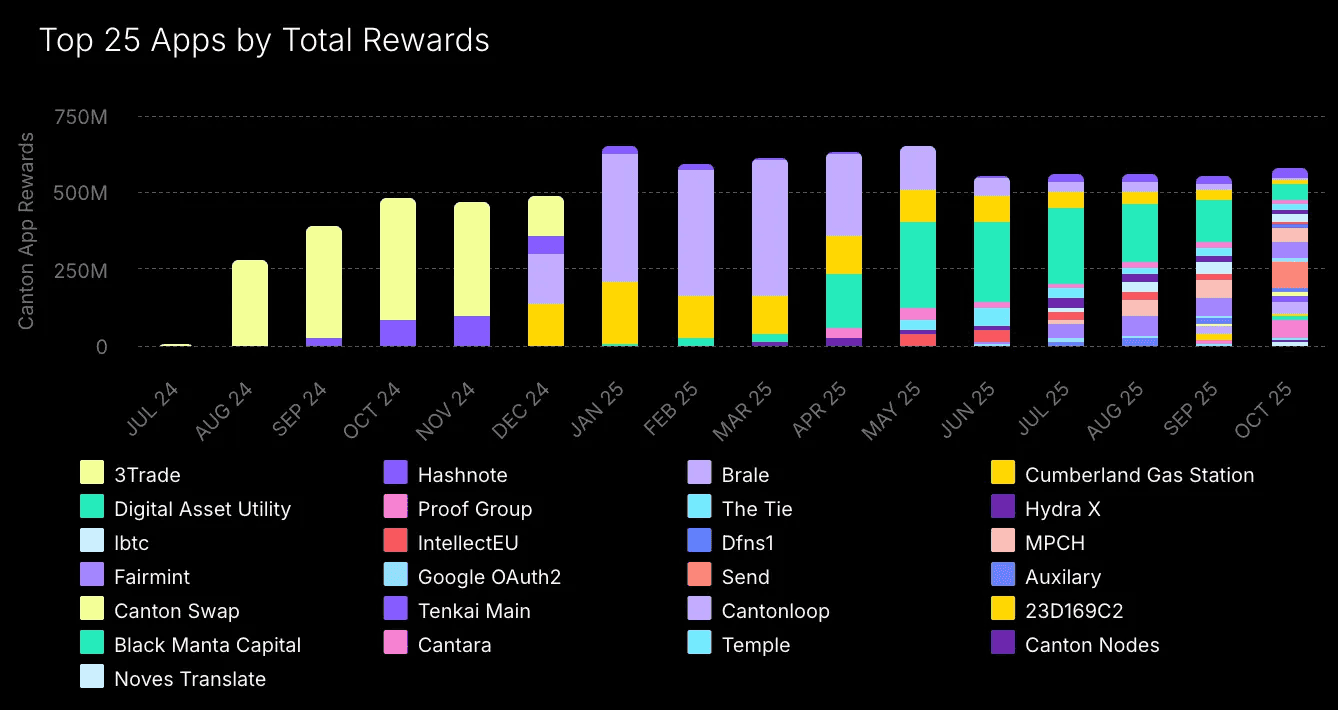

The chart above shows the total app rewards distributed over time. In the earliest months since the network launch, only a couple of apps were live, so rewards were concentrated to one or two apps, 3Trade and Hashnote.

Over time, around January 2025, total rewards climbed up to ~650M with the majority of them being distributed to Brale platform for creating and launching stablecoins on Canton Network. By Q3 2025, Digital Asset Utility is the top app due to providing ecosystem pre-built composable apps, but its share is much smaller. Instead of the early phase where a single app captured most of the rewards, these are now more distributed as the ecosystem matures and daily active users seek diverse utilities.

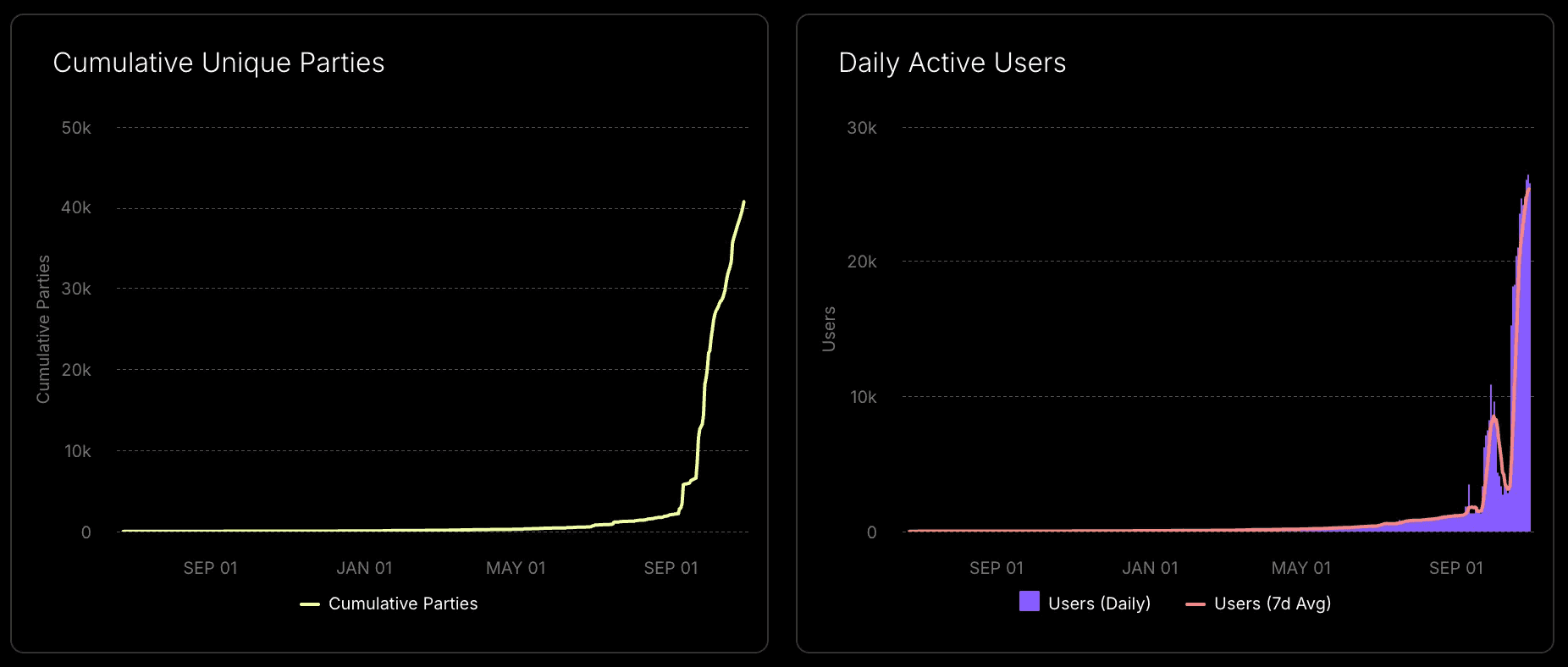

User Base Growth

Daily Active Users (DAUs) remained on the lower end for a large period after the network’s launch, and then surged by Q3 2025. Early, shortly after the network launched, it had only a few hundred daily active users. It first crossed 1,000 DAUs in August 2025, reached 10,000 on September 28, pulled back briefly, and hit 20,000 on October 19.

Currently, Canton has ~27,000 DAUs, with a trendline that indicates close to parabolic growth. Daily transaction count has presented a more steady growth since the beginning, while DAUs were still low, activity was already 30k+ transactions per day and today it exceeds ~780k per day and continues to climb.

Sources:

https://www.canton.network/ecosystem

https://reports.tiger-research.com/p/canton-network-most-realistic-blockchain-eng

https://23136104.fs1.hubspotusercontent-na1.net/hubfs/23136104/Canton_Report_2_5_v3.pdf

https://www.canton.network/blog/canton-coin-flipping-the-script-on-tokenomics