Token Utilities

LEAF

Gas token that can be redeemed for fiat. Each LEAF is backed 1:1 by fiat, at a stable $1 rate. When users deposit fiat into ReLeaf, it gets put into a treasury and a corresponding amount of LEAF tokens is minted; whilst users see fiat on the front end, it is this LEAF token that does the transacting on the back end, and is always convertible for fiat if a user wants.

Witnesses earn LEAFs

Witnesses earn LEAF tokens in the same quantity that were burned as fees, which redistributes fees to users running Witness nodes.

Notaries earn LEAFs

Notaries earn LEAFs via gas payments.

Not on exchanges

LEAFs are not on exchanges, only tradeable within the ReLeaf ecosystem, and redeemable with ReLeaf or ReLeaf’s Telco partners for fiat or benefits.

On-chain

The token will be on-chain despite not being on any exchanges.

RUUT

Governance and staking token used by Notaries (validators). It is a normal token, which will be used to fundraise, will be on exchanges, and will operate as a standard utility token.

Notaries earn RUUTs

Notaries earn RUUT for Notarising, with details outlined in the economy section and in the designed calculator. It undergoes disinflation (like Bitcoin) when minted for Notaries.

Open for Delegation

RUUT can be delegated to Notaries which creates interesting dynamics between various parties. More details below.

wRUUT

Bridged RUUT on other chains.

Not for validation

wRUUT will not be useable as a stake for Notaries.

Economy

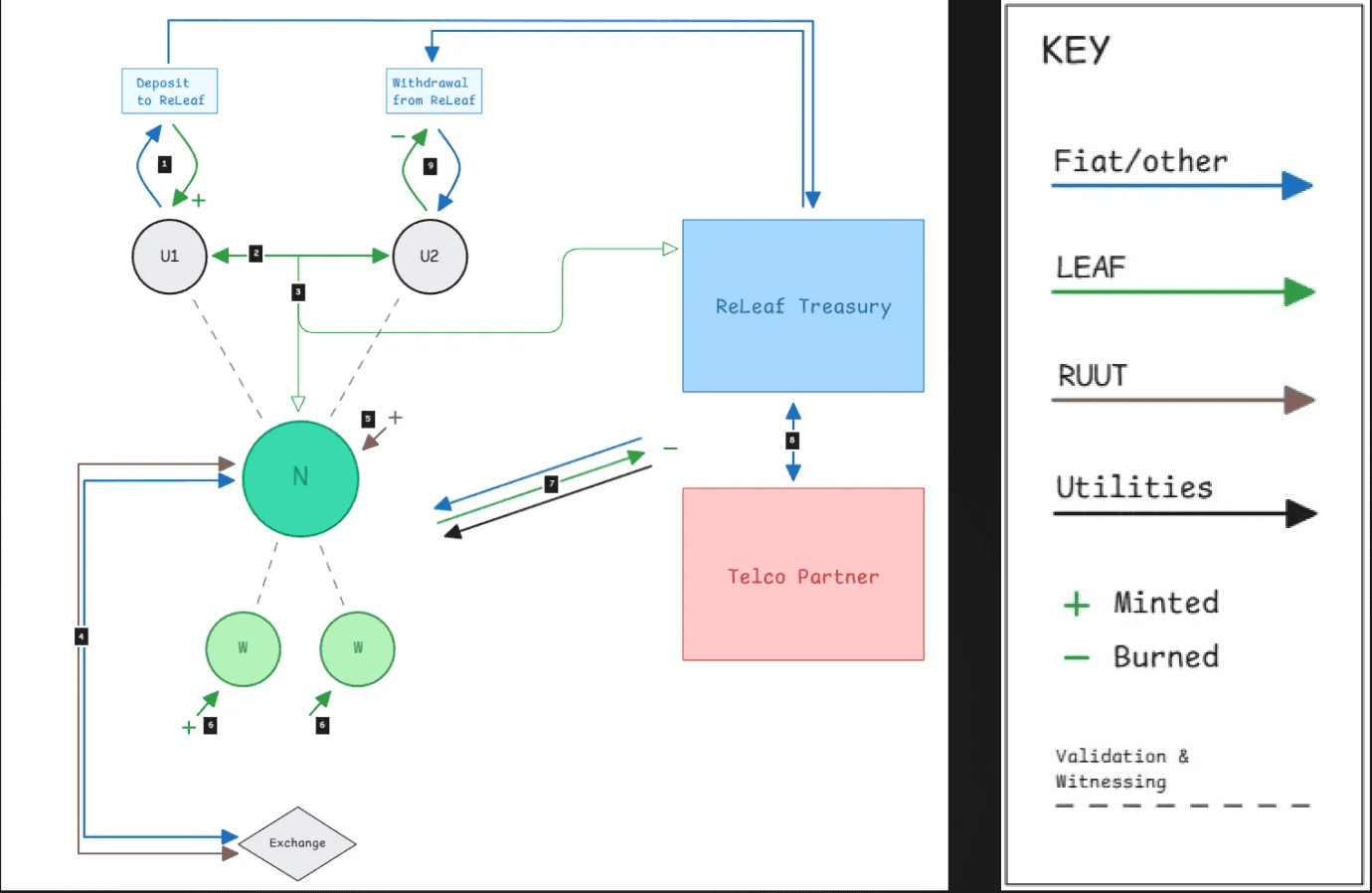

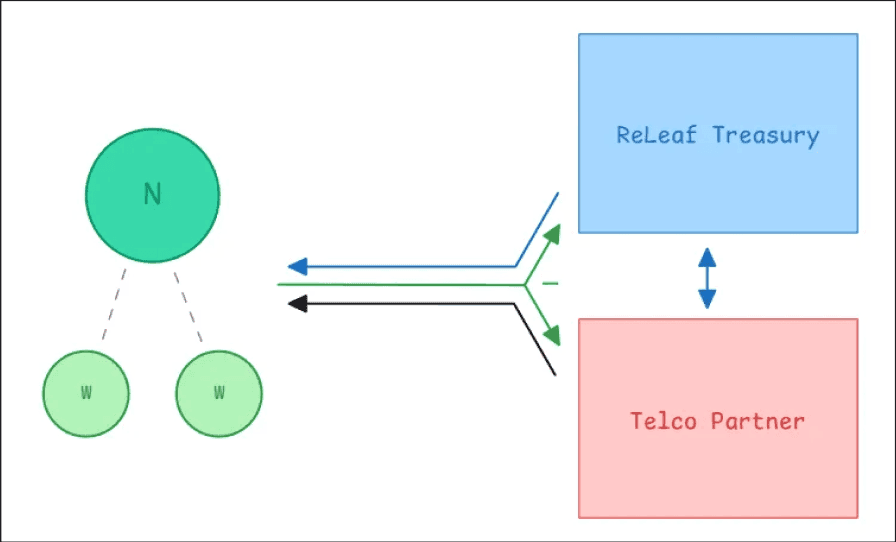

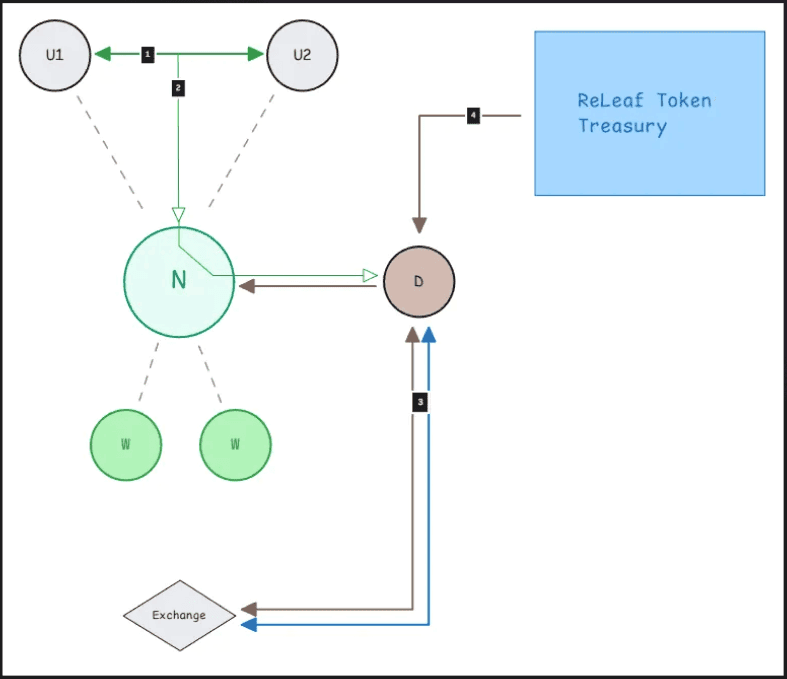

Protocol Economy

The economy has - transaction items shown by the key on the right.

Actors

U1/2 - users using ReLeaf for payments

N - Notary

W - Witness

ReLeaf Treasury - ReLeaf Treasury

Telco Partner - Telco Partner

Exchange - Exchange

Economy Flow

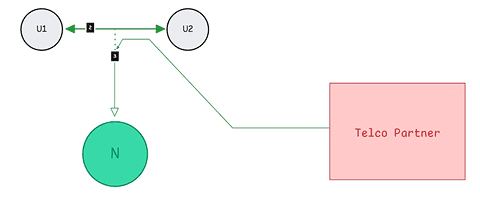

Users

User deposits fiat or cryptos onto ReLeaf, and ReLeaf mints the user LEAFs at a 1:1 value. This fiat/crypto is stored in the ReLeaf treasury. Crypto is likely to be sold for stablecoins instantly to avoid Forex risk.

Users transact.

Users pay gas fees to the Notaries, and a small fee to ReLeaf.

Notaries

Notaries buy RUUT on exchanges and stake it to run a node.

Notaries earn newly minted RUUT for validation (on top of the gas fee).

Witnesses

Witnesses earn newly minted LEAF for witnessing.

ReLeaf and Telcos

Notaries and Witnesses exchange/redeem their LEAF with ReLeaf or with ReLeaf’s Telco partners for either money (from ReLeaf mainly) or benefits (from Telcos) at a 1:1 value. That LEAF is burned.

ReLeaf send fiat (from what the user deposited originally) to the Telco to cover expenses of utilities, but, depending on agreements, Telcos may actually pay ReLeaf for access into this ecosystem as a marketing/customer acquisition cost.

Policies

LEAF

LEAFs are used as the medium of exchange and gas token within the economy, whereby users see fiat on the front end, but the transactions happening onchain are in LEAF tokens. When users pay a small TX fee, it is settled in LEAF tokens, explained below.

The transaction fee is made up of two fees: the gas fee, and the ReLeaf fee.

Transaction Fees

Gas Fee (1/2)

The gas fee is the fee that goes towards the Notaries directly. It is settled in $ value terms, and is calculated simply:

G = gas fee

Min = minimum fee

B = base fee

T = tip / bribe

Minimum fee can be whatever the cost is to confirm a transaction by a notary denominated in LEAF tokens - be that $0.001 or whatever else.

Base fee is the core fee that changes based on network demand to ensure supply meets demand. It can be calculated like Ethereum calculate theirs, starting at a discussed $0.20* and adapting based on network demand. This article clarifies the formulas and links the code base for the fee (albeit I didn’t test it): https://ethereum.stackexchange.com/questions/132333/how-can-we-calculate-next-base-fee

Tip fee is to incentivise Notaries to confirm transactions. Specifically, for the user experience, if a transaction fails / takes too long then users can have a pop up that says “accelerate TX for $0.05” or whatever along these lines, and this will be the optional “tip” that users can apply. This allows the avoidance of clunky Web3 wallet tip selection UXs, whilst still keeping the core mechanism.

*the base fee is set to $0.20 because ReLeaf expects users to transact an average of $20 per transaction, at a rate of 10 transactions per month - if a Telco sponsors this fee (outlined below) then that would be a $2 customer acquisition cost, which ReLeaf believe Telcos will pay.

ReLeaf Fee (2/2)

ReLeaf will charge 0.1% on all transaction fees. The proceeds are split ~50/50 between how much ReLeaf takes as revenue, and how much is burned.

The quantity of burned tokens then gets minted to reward Witnesses, as explained below.

However, if ReLeaf needs more revenue then they can keep more of the fee and burn less LEAF tokens, thus reducing the Witnesses’ revenues to increase their own.

Sponsoring

Since ReLeaf is a customer acquisition strategy for Telcos, there could be agreements in place where the Telcos sponsor the gas fees for users (and maybe even all the fees), as a sort of customer acquisition cost. The way this is done is up to the ReLeaf team but there are different methods:

Telco can reimburse U1 the amount of LEAFs that U1 spent on the TX.

Telco gives ReLeaf fiat thus meaning ReLeaf can avoid taking their fee from users, leaving users to only pay for gas and the network fee of LEAFs that get burned.

Telco can mint loads of LEAFs that progressively get burned to cover the network fees of LEAFs that get burned during transactions.

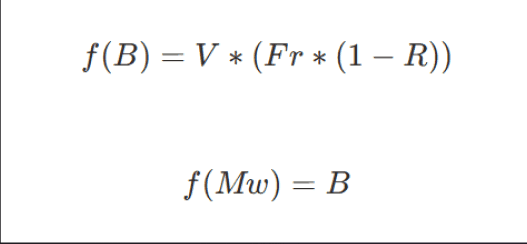

Minting

Witnesses get an equivalent amount of LEAFs minted that were burned by ReLeaf during any transactions. This amount is a fraction of the ReLeaf fee, and is calculated via the following formula:

V - transaction value

Fr - ReLeaf fee as a percent of V

R - how much of Fr is allocated towards ReLeaf’s revenue (function of company costs of operations, etc.; adjustable)

Mw - minted LEAF to the 3-15 Witnesses

B - burned LEAF (from the user who makes transaction)

Rewards Distribution

The distribution of minted LEAFs for Witnesses is split evenly between the 3-15 Witnesses that get chosen to witness a transaction; the higher the transaction, the more Witnesses required.

However, we have decided to cap the dollar value that a Witness can earn for a given transaction at $25. This means that if ReLeaf takes a 0.1% fee on all transactions, of which half goes towards Witnesses, this maximum would be hit if the transaction is $750k.

Fee * TX Value / Max Witnesses = Max Witness Reward , which we can rearrange to get:

TX Value = (Max Witnesses * Max Witness Reward) / Fee , which we can substitute to get:

TX Value = (15 * 25) / 0.0005

TX Value = 750,000

If the transaction is greater than $750k, the excess LEAFs that are due to be minted get distributed between all Witnesses in the network.

This gives Witnesses an even more passive source of income and creates a more fair distribution of rewards, whilst still allowing there to be a “lottery”-esque mechanic of potentially earning a decent amount of money randomly.

In terms of the UI, ReLeaf can create an “Active witness rewards”, and “Passive witness rewards” counters.

The selection of Witnesses happens based on the Witness Reputation Score.

Witness Reputation Score

Determines how often they get picked.

Liveness*

Correctness*

*We recommend these factors to be based on a 30 day moving average to allow Witnesses to redeem themselves back to baseline, but still feel the effects for a long enough period. Notably, this is shorter than the 90 day moving average for Notaries, since Witnesses are not as important.

The calculations and logic are exactly the same as for Notaries, detailed below, except for the additional penalty which Witnesses do not bear.

LEAF Redemption

Notaries and Witnesses can redeem their LEAF tokens from ReLeaf or partnered Telcos.

ReLeaf will always keep a Treasury of fiat/crypto that users/Telcos deposited to mint LEAFs, and will ensure that LEAFs are always redeemable 1:1 for US$1.00. Since LEAFs are not on any exchanges, ReLeaf in essence is the sole market maker, meaning this peg is kept without any troubles.

Telcos also are able to allow users to redeem LEAFs, akin to airlines with airmiles, for different utilities like phone or data payment plans, etc.

RUUT - Validation

Staking Requirement

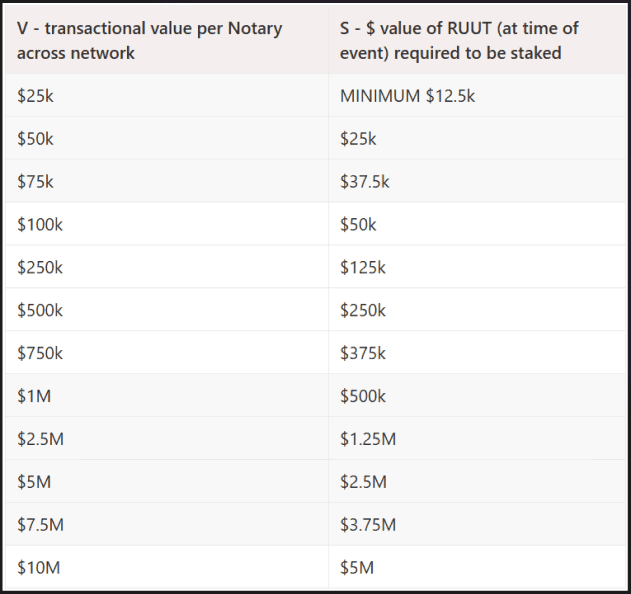

The staking requirement is dynamically linked to the network’s 30-day average transactional volume, thus aligning collateral with potential damage to the network.

Value supported will be a function of transactional value, not stored value.

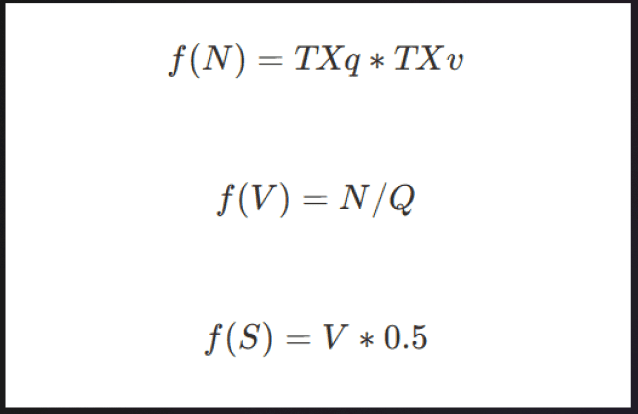

Q = quantity of Notaries in network

TXq = quantity of TXs per month

TXv = average TX value

N = total transactional value across ReLeaf over last 30 days

V = transactional value across entire network per Notary over 30 days

S = Notary stake requirement

However, since S will face high volatility due to the nature of the factors of V, the staking requirement will be adjusted dynamically only when V reaches the next quartile increment within each order of magnitude.

In other words, if when V grows to $250k, the staking requirement would become $125k worth of RUUT tokens at the time of this event and will remain there until V grows to $500k, at which point it would become $250k worth of RUUT at the time of the event. This creates a logarithmic increase in stake requirement that aligns with the absolute dollar volatility range in V.

Note: if V is below $25k, the Notary would still need to stake $12.5k worth of RUUT.

Looking at our calculator, it is clear that Notaries will be earning enough revenue from gas to become fully profitable after around 4 years, and considering this is a liquid stake requirement we believe this is a fair horizon.

Key note: Notaries will have 28 days to stake the additional required RUUT tokens.

It is clear that if Notaries don’t have sufficient RUUT, and will all buy at the same time, the demand shock can spike the price of RUUT meaning that Notaries that were a bit late have to face much higher RUUT prices. However, we believe this will not be a problem for five distinct reasons:

The value of RUUT will go up as more people buy it for speculative or Notary or Delegator reasons as the network grows, meaning we believe a Notary’s RUUT stake value will be already very close to the new requirement if not greater*.

The incremental change in S is often enough this event won’t cause demand shocks.

When prices spike, speculative retail, other Notaries, Delegators, and other ecosystem participants will sell tokens for quick returns thereby balancing out the market. Moreover, ReLeaf can always sell tokens from its treasury in case of price spikes to balance out any black swan demand shocks.

Notaries constantly earn newly minted RUUT tokens, meaning if they don’t sell then they may be able to avoid needing to buy more RUUT.

It is very unlikely that V will change often after initial spikes as ReLeaf opens in new markets, and will likely plateau around a certain value, due to the increased N and thus gas earnings per Notary incentivising new Notaries to join the system and thus bring V back down.

This system greatly rewards earlier Notaries as the value of RUUT grows thereby meaning an early Notary may never need to buy additional RUUT tokens to run Notary nodes. And fundamentally, it’s a Notary’s job to be prepared and keep track of the metrics.

Plus, this is a benefit to ReLeaf as Notaries are therefore disincentivised from selling the RUUT they earn.

Bearish Scenario - what happens when V drops

For V to decrease, N must be decreasing, which means Notary gas revenues will also be decreasing, thus meaning some Notaries will leave the system, which naturally increases V again. This is what point 5 above mentions, but in the other direction. So this is unlikely, unless ReLeaf gets shutdown in a particular market, or loses a contract with a huge Telco partner and isn’t able to replace it.

That said, in the case that it does happen, the same function will occur, and the staking requirement will decrease.

However, to prevent massive immediate sell-offs, Notaries will have an additional 30 days added to their unstaking period - called Strategic Vesting / Unstaking Period.

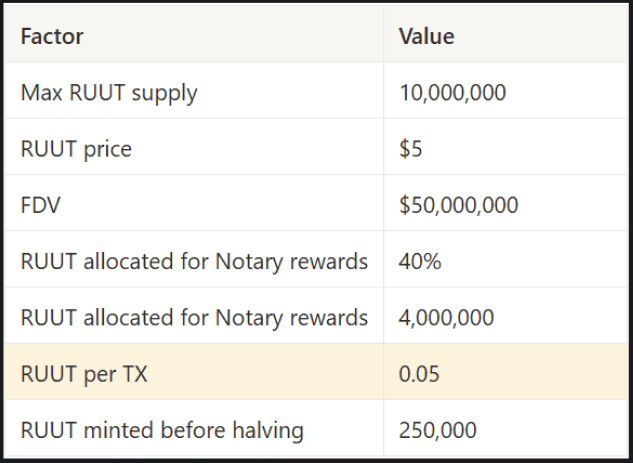

RUUT Minting

Notaries get additional RUUT minted for each block they validate. It is difficult to determine how much RUUT should be minted for every transaction since there are no minimums or maximums involved, however, the core principle is that we want Notaries to earn a relatively consistent amount of RUUT tokens.

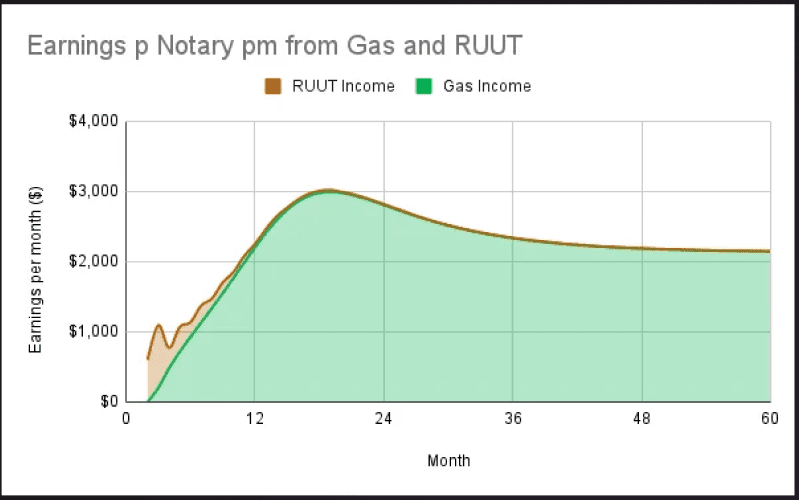

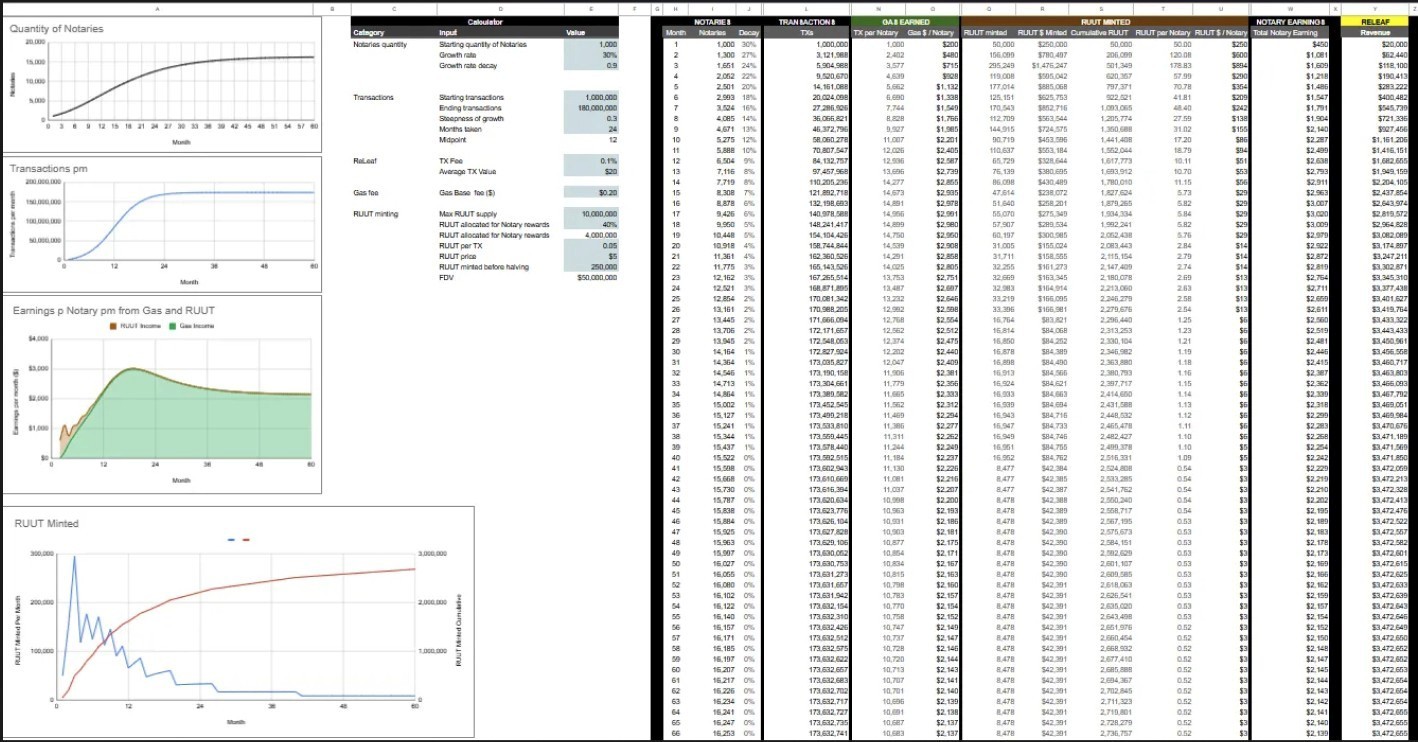

We have built a Calculator to help us determine the factors that go into RUUT minting, and currently the conditions are as follows:

This produces the chart above which visualises the earnings per Notary are supplemented to at least $1k per month. Between months 12-30 there is a spike up to $3k due to the growth of Notaries being slower than the S-curve growth of transactions, but otherwise, the RUUT in the first year does a good job of supplementing the rewards to the minimum ReLeaf wants to sustain.

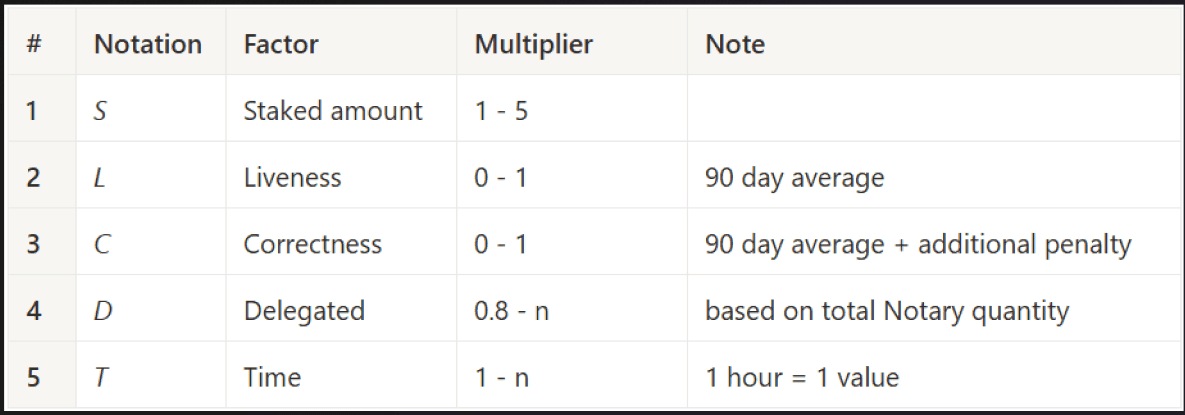

Notary Reputation Score

Realistically, if we have n notaries, we can have the Reputation score increase someone’s chances by n/1 because a Notary cannot be picked twice in a row anyway, thus the concern of a 51% attack doesn’t exist - this means there is no practical limit on how much the reputation score can boost chances of notarising. Thus, since there is no practical limit on the multiplier, we decided to calculate the Reputation score based on each factor separately.

This reputation score will be denominated in “Ballots”.

Notary reputation scores will begin at a base level of 1 for each category and will be impacted by four criterion:

Staked amount

Liveness*

Correctness*

Delegated total

Time

*We recommend these factors to be based on a 90 day moving average to allow Notaries to redeem themselves back to baseline, but still feel the effects for a long enough period.

Note: if a Notary hits a Reputation score of 0, their stake gets 100% slashed.

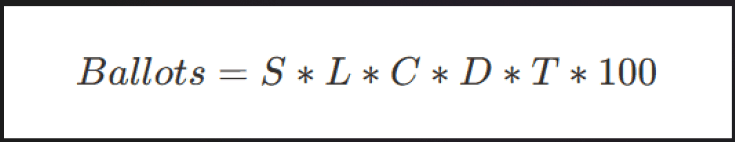

Calculation

The scores for each factor get multiplied together to reach a final score, which then gets multiplied by 100 to get an integer. These integers represent “ballots” in a pool which randomly selects Notaries to Validate: higher rep score = more ballots = more chance of selection.

e.g.

Notary has scores of 3, 0.93, 1, 2, 1, for each factor respectively.

This multiplies out to get 5.58.

Multiplying by 100 we get 558.

This Notary thus has 558 ballots in the selection Pool.

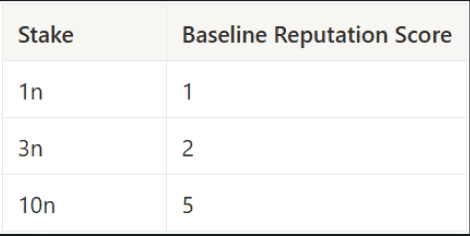

Staked amount

Staked amount refers to the amount of RUUT tokens a Notaries stakes.

When an Notary stakes the baseline required stake of n RUUT, they receive a score of 1, but they can, at maximum, double their score to 2 by staking 3x more RUUT, or triple their score to 3 by staking 10x more RUUT.

This is done to incentivise Notaries to stake more RUUT tokens and benefit from it fairly.

Liveness

Liveness refers to the status of an Notary - if they are active.

ReLeaf will ping Notaries daily to check if they are active. For each liveness check missed, a Notary will lose 0.07 score. This way, if a Notary is offline for 14 days, its Liveness score drops to 0, thus making their Reputation score 0 as well.

3. Correctness

Correctness tracks whether the Notaries are correct compared to the consensus from other Notaries. However, due to the seriousness of this factor, a Notary’s stake can be slashed on top of the damage to the reputation score.

The reputation score of the Notary will go down in line with their slashing penalty, explained below in the bullet points that showcase what happens to an Notary’s stake when one reaches a conclusion the others did not. If their stake gets slashed by 10%, this factor of the reputation score drops to 0.9.

Additional Penalty

In terms of slashing, Notaries will have their stake slashed in the case of malicious action, notably reaching a conclusion during validation that other Notaries did not. We propose a three-strike penalty system, whereby the severity of the slashing grows with each step.

For reaching a conclusion during validation that other Notaries did not:

First strike gets the Notary’s stake slashed by 10%.

Second strike gets the Notary’s stake slashed by 30%.

Third strike gets the Notary’s stake slashed by 100%, eliminating their stake.

Key note: if a Notary gets slashed, the Delegators also get slashed a proportionate amount.

Delegated Total

Delegated total refers to the amount of tokens delegated to Notaries.

Notaries will be able to open their validation to delegation, whereby retail RUUT holders will have the ability to delegate their tokens to earn rewards. This system not only generates rewards for retail users, as well as more rewards for the Notaries open for delegation, but it creates a natural system of incentive alignment where higher earnings are directly related to higher levels of trust as represented by the delegation. ReLeaf will continuously track the total amount of tokens delegated to Notaries (can be updated daily).

The score will be based on the total quantity of Notaries and their share of RUUT delegated.

For example, if 3 Notaries exist in the network the maximum multiplier possible is 3. If there is a total of 1,000 RUUT delegated, whereby Notary A received a delegation of 700 RUUT, Notary B received a delegation of 200 RUUT, and Notary C received a delegation of 100 RUUT then:

Notary A receives a score of 2.1 (3 × (700/1000));

Notary B receives a score of 0.6 (3 × (200/1000));

Notary C receives a score of 0.3 (3 × (100/1000)).

For Notaries not open to delegation, there will be a minimum score of 0.8, so that a Notary is not impacted by this decision too heavily. However, it’s low enough to incentivise Notaries to be open to delegation so that ReLeaf benefits from more RUUTs being locked up.

For Notaries open to delegation, there will be a minimum score of 0.8, so that a Notary that has a relatively lower amount of delegated RUUT to the point that its rep score mathematically drops below 0.8 tokens isn’t disincentivised to stop being open to Delegation, considering the minimum score of those who are not open to it.

In the example above, Notary B and Notary C will thus have a minimum score of 0.8.

Note: to balance things out, ReLeaf has 10% of its tokens allocated to Delegator rewards, so they can incentivise delegation towards smaller Notaries, or across all Notaries if they prefer, by rewarding Delegators additional RUUT tokens:

Can be a 1:1 match with their LEAF rewards value;

Can be a simple match of how much the Notary earned in RUUT (i.e. if the Notary makes 0.05 RUUT tokens per TX, the Delegators will earn 0.05 RUUT / quantity of Delegators).

Time

Time is also a function, whereby for every hour (TBD) the amount of ballots in the pool get multiplied by that value.

RUUT - Delegation

Notaries will have to pay a share of their LEAF (or RUUT) proceeds to their Delegators. We recommend that this be capped at ~10-20% of the revenue (TBD by the team), because all Notaries will resolve to giving away the maximum quantity of tokens they possibly can to incentivise delegation to their nodes - this will the average income of Notaries will decrease by 10-20% which may disincentivise Notaries from joining the system as the yield per year decreases, which thus reduces buy pressure on the RUUT token.

Retail users have the ability to delegate RUUT to participate in rewards. This is a dual-edged sword however, because whilst higher delegation can increase a Notary’s chance of being chosen and thus increase its - and thus the delegators’ - rewards, any penalties applied to Notary will also be applied to its delegators.

Hence, delegators must choose their Notary wisely.

The relationship between delegators and Notaries is naturally aligned: delegators want to delegate to Notaries that have the highest Reputation Score as it will yield the most rewards, which subsequently boosts the Notary’s score further. It is in the Notary’s best interests to perform their duty well to keep their Reputation Score competitive.

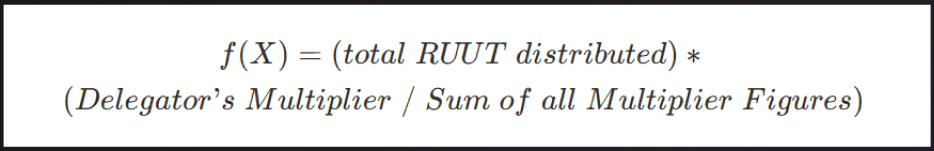

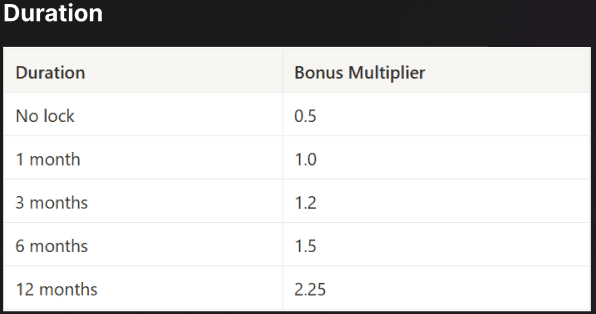

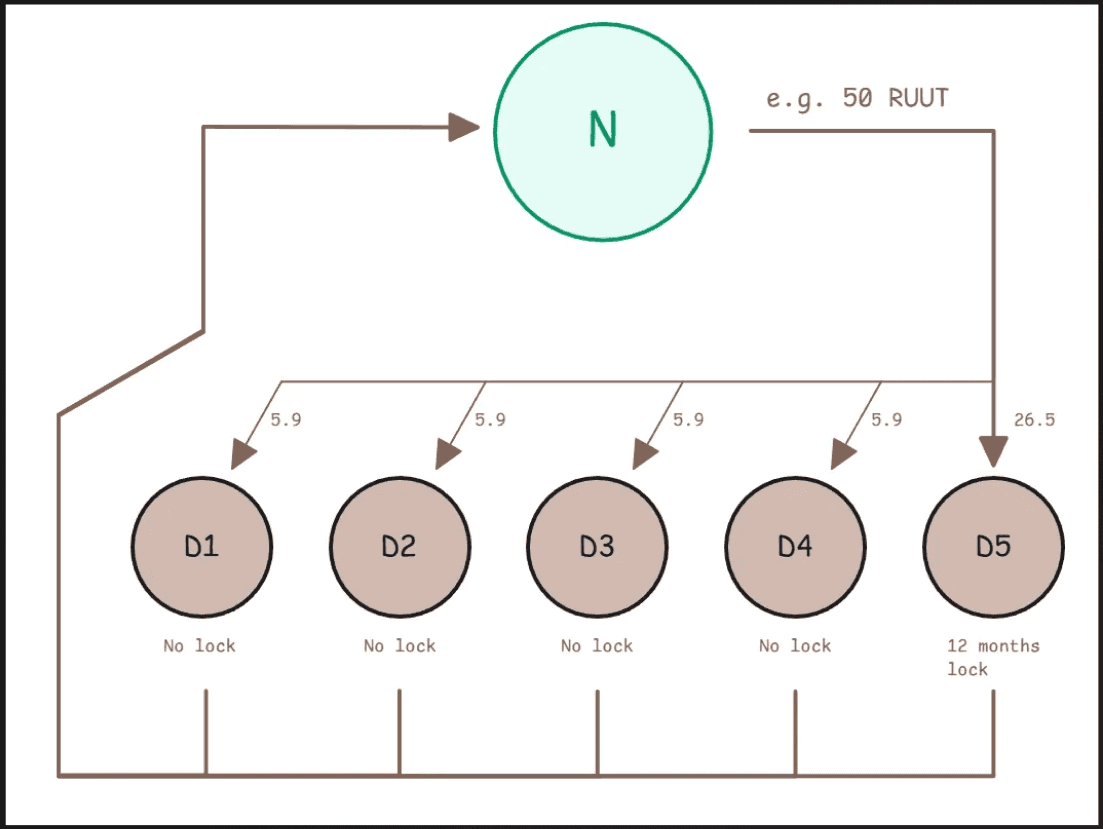

Delegator Multiplier

We are introducing a delegator multiplier, to further align incentives and create additional token sinks. Unlike Notaries, delegators do not have the same scoring system of their rewards for two reasons: they don't have any responsibility in the network, and delegation provides a great part-time token sink. Hence, the delegator multiplier is based on the lock duration.

Locking tokens for longer durations increase the share of their rewards in relation to their peer delegators. The lock, and corresponding bonus is outlined below, and is applied via the following formula:

X = how many RUUT tokens a Delegator will earn.

For example: if the delegators of Notary A are getting 50 $RUUT tokens for the month, and there are 5 delegators in total, the rewards will be split as a function of the sum of their bonuses in the following manner:

Delegators 1-4, with no lock have a multiplier of 0.5x.

Delegator 5 with a 12 month lock has a multiplier of 2.25x.

If we add all 5 multiplier digits, we get a total figure of 4.25.

Delegators 1-4 will thus earn (50)*(0.5/4.25) = 5.88 RUUT each.

Delegator 5 will thus earn (50)*(2.25/4.25) = 26.47 RUUT.

This mechanism compels Delegators to lock their tokens to avoid significant reward dilution, a la the classic Prisoner’s Dilemma. Since the reward pool remains unchanged as a whole, failing to lock tokens not only forfeits the opportunity for higher rewards but also results in lower returns compared to a scenario where no participants lock their tokens.

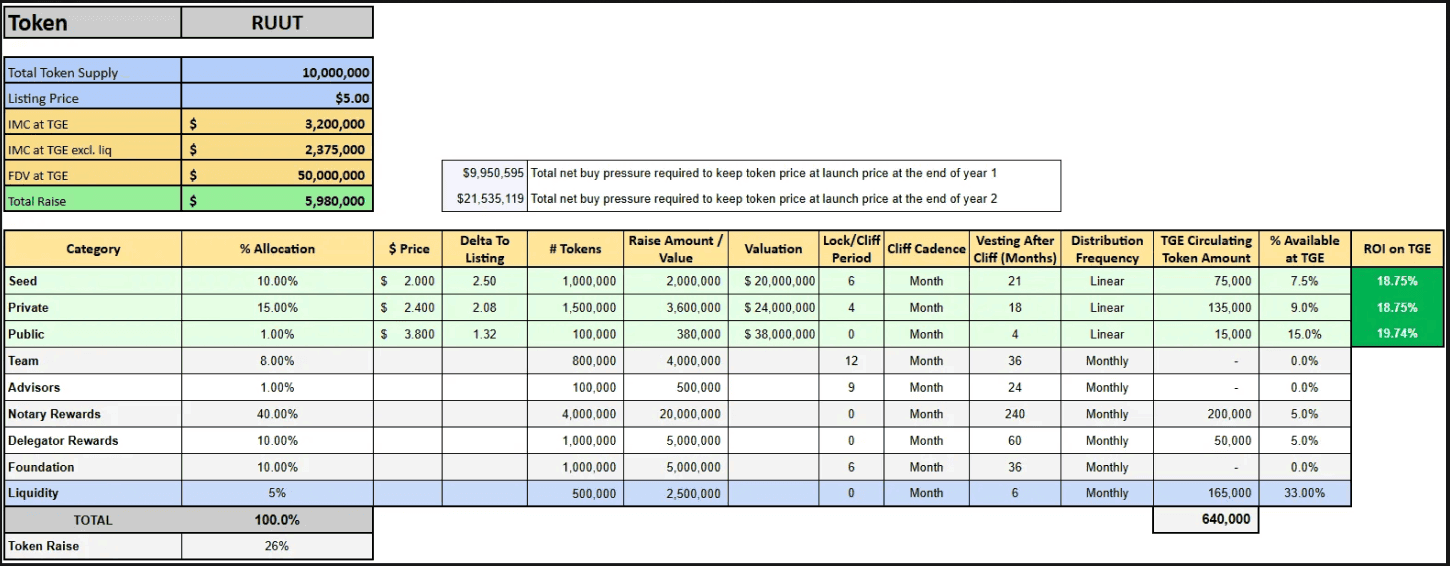

Tokenomics

https://docs.google.com/spreadsheets/d/1My_qNJfhwKcMSwt1c04F0PxexbQFIoTt/edit?usp=sharing&ouid=109013083772926438001&rtpof=true&sd=true

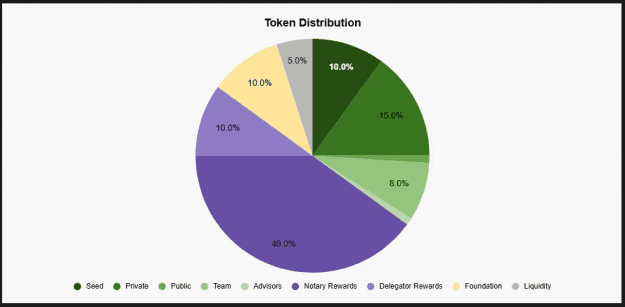

The tokenomics for the RUUT token have been carefully thought out to ensure the distributions between tranches are backed by growth projections, and to ensure alignment between all parties.

The FDV has been set to $50M as with the strong connections and GTM we believe there will be great demand for the RUUT token and the valuation will rise rapidly, given the staking requirement and the profit potential for the Notaries. Fundamentally, we believe the amount of buy pressure from Notaries wanting to get involved would skyrocket the FDMC of the token into mid-9-figures and beyond, if ReLeaf close even 1 big Telco partner currently in discussions.

Alas, in the case of over-positive estimations, 40% of the supply for RUUT will be emitted on a per-transaction basis, meaning if the project isn’t doing as well as expected, the actual valuation will be closer to $30M, with long vestings stabilising the sell pressure.

The distribution between entities has been set at 50% towards rewards for active participants, and the remaining 50% between operations, investors, and team.

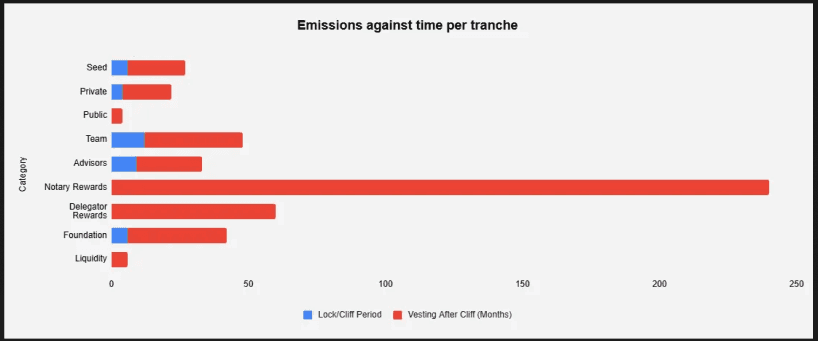

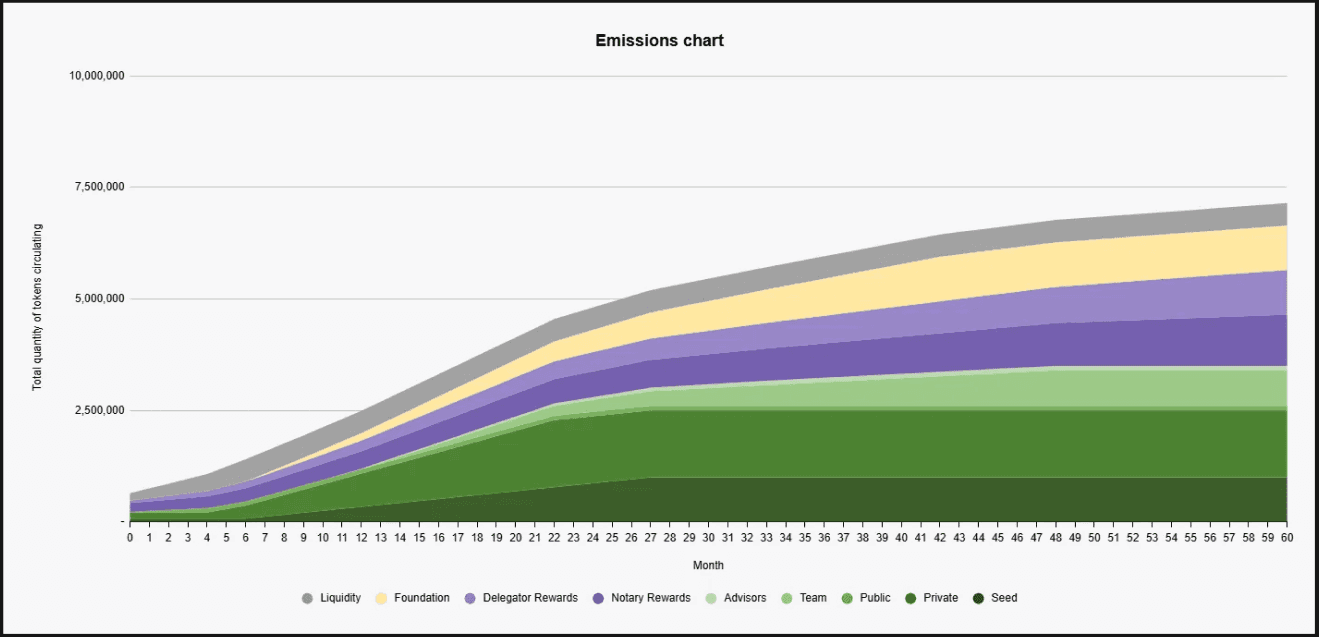

The vesting has been designed to balance out all parties and ensure that there isn’t an oversupply of tokens into the market at any point.

The emissions as stated are slow and steady, in line with projected growth which accelerates in the first year and slows down into the third. This aligns with ReLeaf’s plans to expand into the LatAm market.

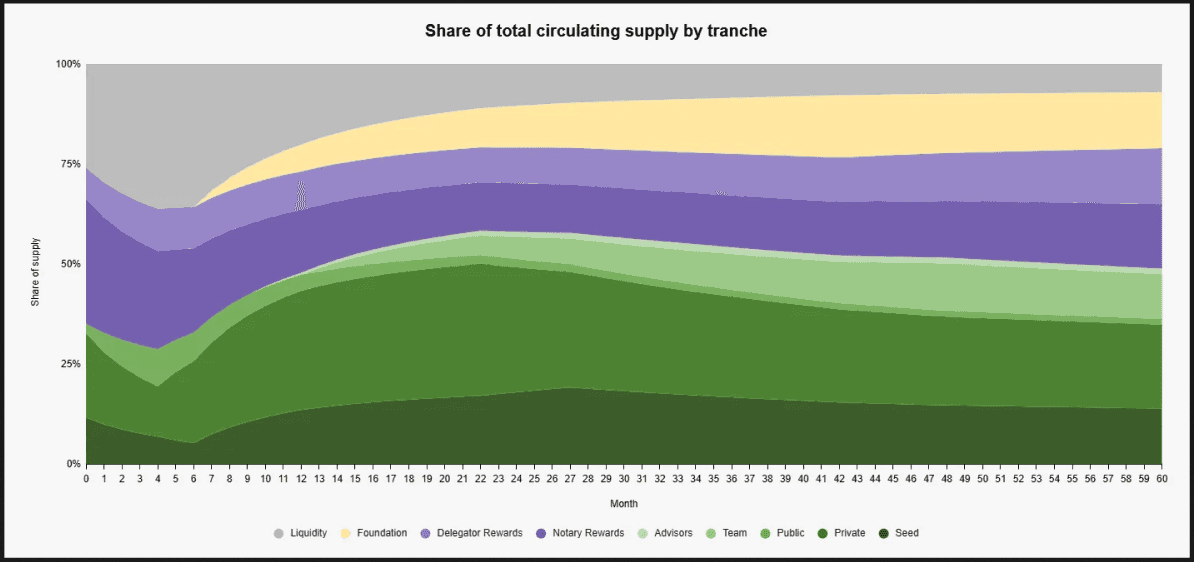

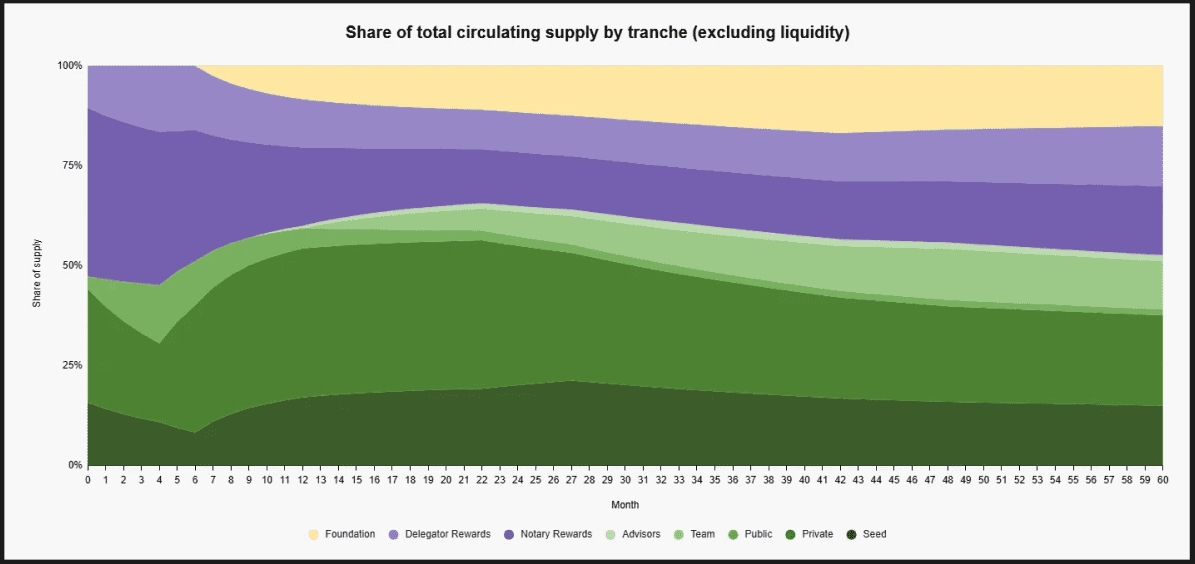

Looking below into the share of emissions, it is clear that ReLeaf’s priority is making sure the community has sufficient rewards whilst being acutely aware of the launch being in the later stages of the market and likely with bearish conditions due - hence, investors have a big share of the circulating supply as their tokens should come relatively early.

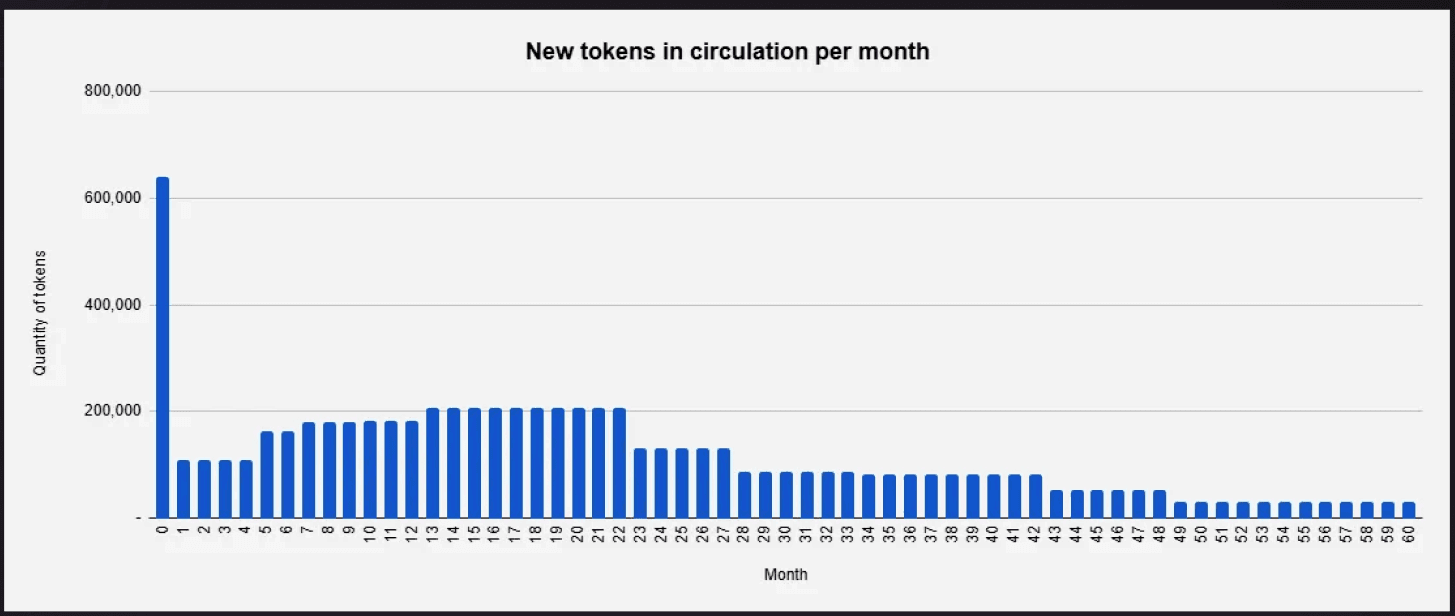

Looking at the unlocks on a month by month basis, we can see the tokens gradually coming into circulation faster up until the end of the 2nd year where they slow down significantly.

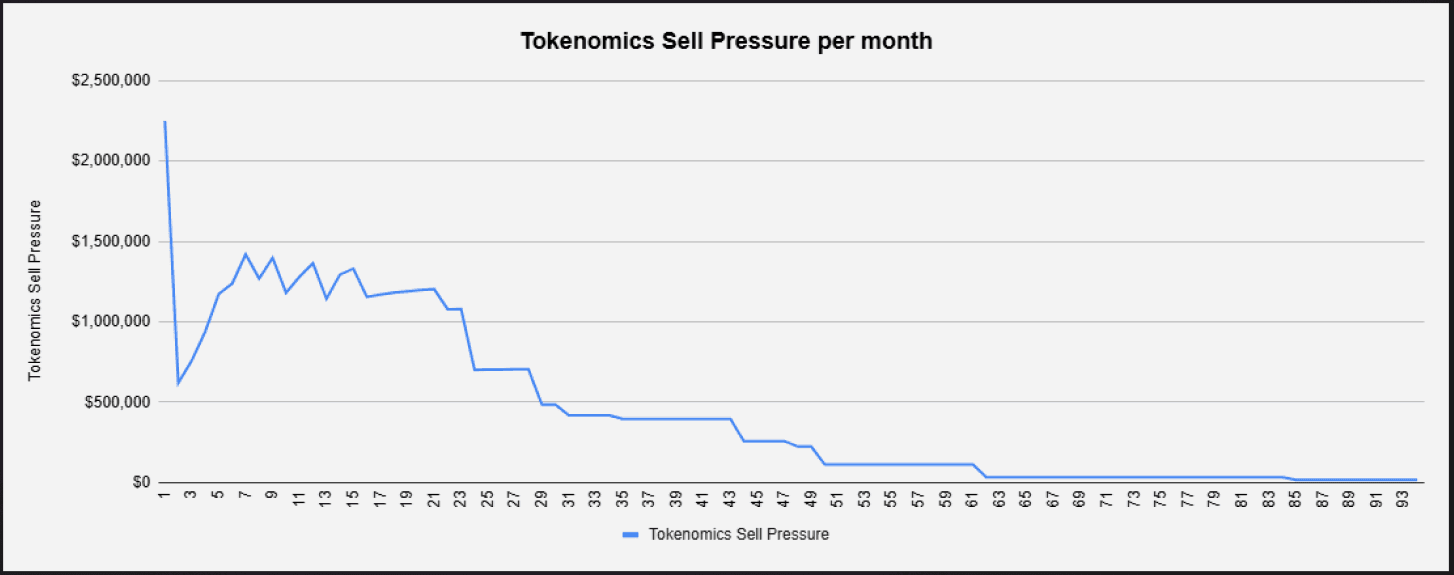

Without modelling recursive buy/sell pressures, we have a super high-level expectation of sell pressure, done by calculating new tokens and multiplying by launch price, indicated below.

Investors

The investor section has been redacted - for more information on what this looks like please contact Simplicity Group directly.