Disclaimer: Nebulas Finance has since rebranded to Rowa

Abstract

Audit Intention

The purpose of the audit is to review the token utilities, economy, and tokenomics proposed by Nebulus Finance, to ensure the token accrues and retains as much value as possible whilst aligning the actions of every user in the ecosystem towards a similar goal. We will evaluate the token utilities on the basis of value as well as the extent of their derivation from product. We will evaluate the economy, similarly, on the basis of value as well as the legitimacy of its policies and its ability for incentive alignment. We will evaluate the tokenomics on the basis of ensure supply and demand, ensuring the equilibrium price of the token isn't below listing price, as well as confirming the emissions align with market conditions. Our focus is sustainability and longevity of the token and overall ecosystem.

Audit Process

The audit was completed with the following order:

Understand the product/service of Nebulus and the direction the company is heading

Analyse the token utilities and economy

Analyse the tokenomics

Suggest improvements and implementations of any new ideas

Company Data Provided

The data provided by Nebulas finance is outlined below and was at the core of our audit.

Onboarding deck

Pre-sale deck

Whitepaper [Outdated]

AUM Protocol BP (financials)

AUM Token Utility Update

Executive Summary

The $AUM token has a plethora of utilities and a very detailed policy design, ensuring good alignment and a wide array of token sinks-crucial for a healthy, long-lasting, sustainable economy. The emissions and vestings are also long and good.

If Nebulus launches with projected users and revenues, and avoids selling Foundation and Treasury tokens in the 1st year, they remain net positive in buy pressure, even if all Asset Token stakers lock for max duration and all VCs sell - assuming projections hold. To sell tokens on top of the above, they need $4.6M in speculative buy pressure, achievable with strong marketing, or by only selling what VCs don't.

Utilities & Economy: 8/9

Tokenomics: 7.5/9

Audit

Utilities & Economy

Purpose: 8/9

Inherently doesn't need to exist, but is tied to the product in every way imaginable.

Value Accrual : 7/9

There are a plethora of token sinks but tiers may not add enough value.

Incentive Alignment: 8/9

Incentives are aligned between stakeholders

Policies: 8/9

Well thought out and detailed.

Utilities

Token gating functionalities - baskets, $AUM staking, Asset Token AT staking, access to speculative markets, and a banking suite.

Membership Tiers

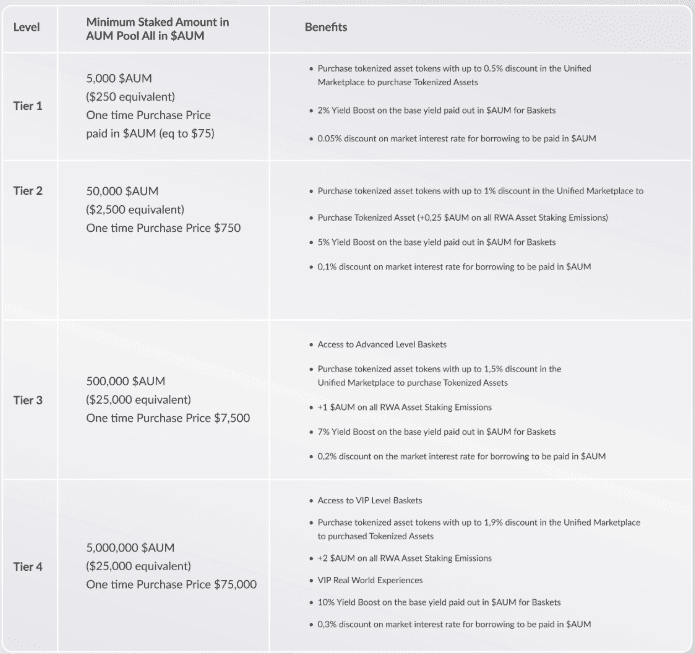

These membership tiers are well designed, with affordability for different types of users in mind. The One-Time-Purchase fee being around 1/3 of the staking equivalent allows users to get involved with higher staking tiers for cheaper if they want to get the advantages of the tiers.

Requiring users to stake SAUM to access different levels of Baskets, as well as other additional benefits is a great way to align the products of the company with the token. It is unclear whether the benefits that users get in the tiers are worth the tier costs since it's impossible to value things like "Access to VIP Level Baskets" or "Real World Experiences" or even how much boosted yield users will get since that's a function of initial stake quantities, but it seems fine. The main concern out of this is in fact whether Tier 1 would be appealing enough for users who only have enough cash/interest for the first tier. It is unclear to us whether retail users would care about the first tier, and thus Nebulus might be missing out on a lot of potential token stakers.

Asset Token Staking

Nebulus allow users to stake ATs in different products within the ecosystem and on top of generating real yield from what the ATs are used for, also emits SAUM tokens in increasing values based on longer lock ups (good incentive).

The team created LSTs as a receipt for stakers which is good.

The emissions of $AUM tokens are much lower and much more reasonable than they were before:

Now with an allocation of 25% of TTS and much lower daily emissions;

Tier boosts are now coming from redistributed tokens from the buyback, which creates a much more sustainable economy;

The amount of SAUM released per day per stake is smaller;

The team is now burning tokens that they buyback too.

Overall, the idea is simple: incentivise AT buying and staking (which generates Nebulus revenue via fees), and reward users with $AUM (on top of real yield) which will be bought back and burned/locked over time.

The core caveat is to ensure that the value Nebulus gets from this incentive is greater than the cost of buybacks and burns/locks. This is difficult to say without any real user data, but the good thing is it can always be tweaked post launch.

The team also introduced a guard rail cap, which ensures that there is a limit on how many $AUM can be "minted" by the stakers. Set at 1.5x the total burn+lock quantity for the day. Since burn+lock comes from revenue which comes from users, and minting quantity is a function of usage, in our opinion there will be overall net inflation until the halvings start ™to come in.

That said, again, without user data it's impossible to tell, and having a 1.5x cap is fine so as to assist with the cold start problem and not limit too greatly how much rewards users get when the protocol is in its early days post launch.

Crucially, the ATs will now be re-deployed so that $AUM emissions are supported by verifiable cash flow. This is great news, as it creates real value behind the emissions, and allows Nebulus to earn from its TVL.

Insurance Pools

Users pay to insure their assets. Nebulus is considering creating an NFT or some other asset as a receipt of the insurance, which works well. Donʼt allow this to be traded on secondary markets as this removes revenue from the pool so if done then must be done with fast expiries which makes it a bit useless.

AUM defines the components and process for the insurance showcasing their knowledge of the idea. Good.

The formula to calculate premiums works well, albeit weʼre not actuaries so cannot confirm whether itʼs sufficient from an insurance POV, but it seems reasonable considering it factors in probabilities of events and coverage ratios.

The 1.2x Coverage Ratio is good, with Nebulus stating they can pause issuing new policies, raise premiums, or bring in more capital through reinsurance, if the value falls below 1.2. However, “canˮ implies they might not, and more importantly since 1.2x Coverage Ratio is calculated as Pool Assets/Total Potential Claims, it means Nebulus needs to ensure its potential claims calculations are well calculated, as a ratio of 1.2 doesnʼt leave much on the table in terms of safety, especially considering solvency ratios for UK-regulated insurers is 188% as of 2023/24 (i.e. a CR of 1.88x).

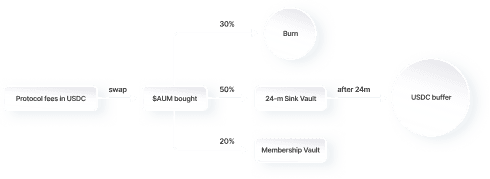

Buybacks

The buyback system as explained in the doc is well thought out, with the protocol revenue being used to burn, reinvest into the vault, and locked up for future use - this prevents sell pressure and acts as a huge token sink in the economy, whilst still redistributing revenues between members and future token plans.

The only drawback is the 24-month lock which may be too long, as revenues from today would be better to use today to scale faster, but if Nebulus prioritises token price and generates sufficient revenue from other sources then this is fine.

That said, these tokens will be used to top up the insurance pool and provide liquidity, which may not be the best use of tokens because both of these purposes are token sinks inherently, so locking the token for 24 months prior is just a wasted use of tokens that would otherwise be generating value for the project.

The fees that facilitate the buyback are detailed in their own respective section, with Nebulus taking fees on all of their products and services. It is apparent that users have a choice of using USDC or $AUM to pay fees, and one way or another since the protocol is using its revenue to buyback tokens this works out exactly the same.

The team says they will only use profit, not revenue, to engage in the buyback, so thatʼs fine.

With this in mind, itʼs important to check how much the fees would actually end up being after accounting for expenses, and by extension what the actual resulting emissions graph will look like considering the 1.5x cap.

$AUM Economy

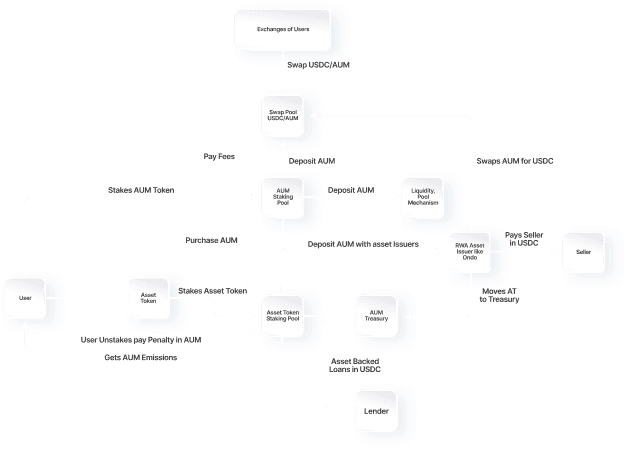

The $AUM economy is rather simple:

User stakes ATs

User gets $AUM emitted

User uses $AUM for participate in the economy

There are more complexities with the ATs, but the $AUM token doesnʼt do much. The simplicity of this diagram doesnʼt imply a lack of utility of $AUM within the ecosystem via which it can accrue and retain value because there can be a lot of value within the utilities users can exchange the token for despite the flow of value itself being only two dimensional.

The $AUM token, as discussed above, is a gateway to the ecosystem in many ways, and is thus very useful.

Incentive Alignment

There is strong alignment between users and token holders.

Users are overlapped into being token holders by force, since users in almost every activity either need to own or stake $AUM, or theyʼre earning it to use. Whilst this can create friction, users of Nebulus will be Web3 native, so the friction is relatively small.

And since the token is greatly tied to all of the products, its price is thus tied to user quantity.

This creates strong alignment of incentives between token holders and users because token holders need users, and whilst users donʼt need token holders per se, the value of their rewards and holdings go up with greater quantities of speculators (i.e. token holders); thus, both parties are aligned.

Nebulus Finance also has a strong alignment with users as they incentivise everyone to buy and hold tokens to access the products, and generously yet carefully reward users for participating in the ecosystem, thus creating a nice value flywheel. Moreover, the fact that ATs are now re-deployed generating revenue for Nebulus and backing $AUM emissions with real value creates a solid self-sustaining economy.

The only concern is in the staking tiers and whether Nebulus is offering enough benefits to its users, particularly in Tier 1, to find staking enticing.

Policies

The policies for each utility are greatly detailed in the Token Utility document provided by the team. We assessed the crucial ones above, but have ran through the logic to understand how the token works, and everything looks good. The only problems are already discussed above:

Staking tiers may not offer enough benefits;

24 month lock on bought back tokens;

Coverage Ratio may be too low;

When halvings happen.

Tokenomics

Emission/Distribution: 8/9

Solid distribution, great vesting schedules.

Net Pressure & Valuation: 7.5/9

Valuation is fair given projections

Emissions & Distribution

RWA Onboarding Reserve

Nebulus will allocate 25% to the RWA Onboarding Reserve - i.e. the tranche with the $AUM rewards emissions. This is a good chunk to give out as rewards to users who stake Asset Tokens.

As per the detailed document, for every $100 worth of ATs staked, Nebulus will emit a small amount of tokens that grows exponentially if users lock up their ATs for 3, 6, 12, and 24 months. The fact that Nebulus is not offering any $AUM emissions if users donʼt lock up ATs is good, as it further showcases that they are truly using ATs to generate more cash flow (which they canʼt do with liquid staking).

As per the table, the maximum users can get is 5 $AUM per day for every $100 worth of ATs they stake. At $0.01 per token, ceteris paribus, this is equivalent to a 18.25% APY (since if I was to stake $100, in a year I would earn $18.28. At the maximum level, this is a relatively sustainable APY to offer considering Nebulus will be redeploying these funds to earn real cash.

On the other hand, looking at the minimum, we may see a slight issue again. For those only locking for 3 months at a time, for every $100 they lock they will get 0.25 tokens per day, which over the course of 3 months equals 22.5 $AUM, or $0.23 in dollar value - a return of 0.23%. This is useless, and may as well be scrapped entirely.

The 6 month stackers have a return of 1.35%, and 12 month stakers of 7.3%, which are more sensible.

We would recommend increasing the 3 and 6 month lock rewards to 0.75 and1.25, $AUM tokens per day.

Nonetheless, to counter any potential hyper-inflation, Nebulus inputted a guardrail as discussed above. This is a great mechanic and should serve Nebulus well, since it limits the amount of tokens “mintedˮ as a function of 1.5x 80% of the buyback tokens.

Hence, if there is $50M worth of ATs staked for 24 months, in a year that would pay out 912,500,000 $AUM, or $9.125M worth, ceteris paribus, however, only if AUM makes enough revenue.

Per day, that is 2.5M tokens, which requires Nebulus to buyback a total of 2,083,333 per day, of which 1,666,666 will be burned and locked 80% of the bought back tokens). This means Nebulus needs to earn $20,833 per day in protocol fees in order to emit the total amount of 2.5M tokens. This is $625k per month, or $7.6M per year.

If they do not earn this much, (also consider we are assuming all $50M of current soft-committed TVL is stacked for 24 months, whereas in reality it will be nowhere near that quantity), then the guard rail will drop the emissions.

There are 11 types of fees that Nebulus earns (detailed in the doc), so itʼs impossible to calculate how many users they need to have in order to account for this, but, given the guard rail, we believe the $AUM token will fare well even in the most inflationary potential environment within the economy.

Overall, in a worst case scenario, thatʼs $750k worth of $AUM sell pressure, when Nebulus only buys back $625k. This is a net deficit of $125k, per month, which we are sure is very likely to be comfortably absorbed by all the other token utilities within the ecosystem.

Note: the above token emissions x token buyback x guard rail relationship is well designed and self sufficient. Alas, that is only 25% of the supply.

Other Emissions/Distributions

Other tranches are fine in allocation as per the recommended changes.

In terms of the vestings, the Pre-Sale vesting is long and healthy, with the Treasury having the same schedule. The Foundation has the longest vesting, which is also healthy.

The Airdrops & Marketing tranche doesnʼt have any data however, so unclear what is going on there, but given itʼs only 1% of TTS it doesnʼt particularly matter even if Nebulus unlocked it all on TGE.

Valuation - $60M FDV

The financials representing Nebulus revenue are yet to be updated with all the new revenue streams, however, they are sufficient to analyse whether the new $60M FDV is fair.

Weʼll assess the buy pressure first since a big portion of the sell pressure is derived from the buyback opportunity.

Note: we are assuming the maximum amount of emissions based on maximum AT lock ups, and that the full 20% investor tranche will be selling tokens, which are quite heavy assumptions on the sell pressure side.

Buy Pressure

Buybacks (Source 1)

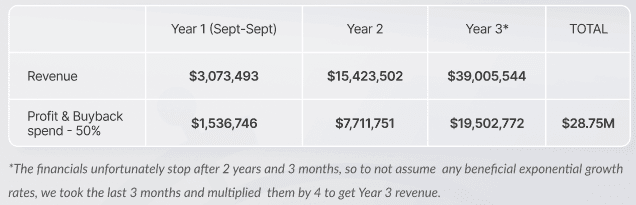

If we assume that all fees and subscriptions are paid in the token, or by the same effect all revenue is used to buyback the token, we get a total revenue of $28.2M over 3 years.

For buybacks, we can assume that Nebulus has a profit margin of 50% (it is unclear) of which the entire remainder will go on buybacks.

This puts total buy pressure at $28.75M over 3 years, with the amount spent on buybacks equalling the net buy pressure.

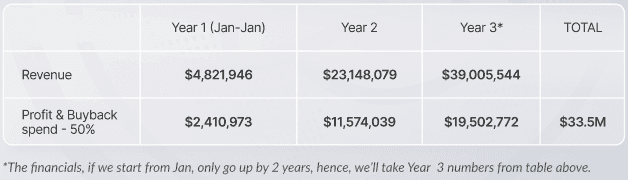

Nebulus Finance do state that they are only going to launch the token once they have 20k MAUs, which is twice as high as the starting point in the financials that were used for the calculations above, but we still get relatively low numbers.

This puts total buy pressure at $33.5M over 3 years, with the amount spent on buybacks equalling the net buy pressure.

Crucially, this means that due to the emissions cap the absolute maximum number of AUM tokens that can be emitted from the RWA Onboarding Reserve in the first year will be 482,194,600 ($2.4M*0.8*1.5 / 0.006).

Users 2 (Source 2)

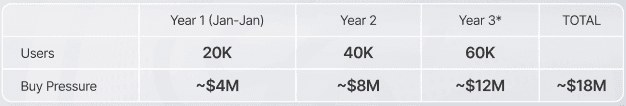

Nebulus currently predicts to grow from 20k to 154k users in Year 1, and to 1.3M in Year 2.

AAVE currently has 70k MAU (according to Token Terminal, and 50k according to DappRadar so letʼs stick with 70k), so we will ignore Nebulus numbers and take 1/3 of AAVEʼs users for the first year, and 2/3 for the second year.

Thatʼs around 20k and 40k MAU.

Based on research, an average user holds $200 worth of tokens, so weʼll take these numbers.

We appreciate this is napkin maths, but itʼs enough to calculate whether the FDV is fair to the best of our ability given the projectsʼ early-stage.

Sell Pressure - $46.3M (3 Years) / $23.7M (3 Years)

At a supply of 10Bn tokens, the RWA Onboarding Reserve has 2.5Bn tokens.

For the first year, since the emissions cap will limit the emissions to 482,194,600 due to low revenue, that will be our emissions.

For the second year, Nebulus expects to grow from $200M to $655M TVL, but weʼll take the conservative estimate of $200M. At $11.5M buyback potential, the emissions cap limits emissions to 2,314,807,800 tokens, but due to halvings, emissions would be much lower. According to our calculations, it would be 1.1Bn.

Adding all the other tranches (excluding Liquidity and Collateral pool), we have the following unlocks in the first year. We will also calculate sell pressure excluding the Foundation and Treasury tokens for interest.

Over 3 years, thatʼs a total of $46.3M worth of tokens unlocked and likely sold into the market.

Optimistic scenario Good news is that without the Foundation and Treasury tokens, the number of tokens is actually almost half, at $23.7M.

Net Result

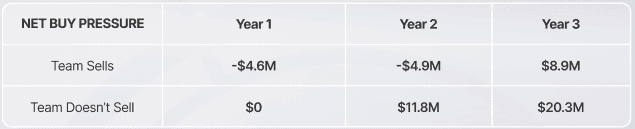

Summing the buy pressures value and taking away the sell pressure value, we get the following table:

Whilst we can appreciate that we have not accounted for speculative buy pressure, we can calculate some more.

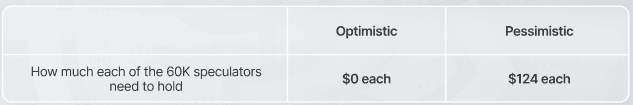

AAVE has 186k token holders, so if we take 1/5 of that and apply it to Nebulus, at 37k token holders, they would need to each hold the following $ value of tokens for the price to not fall below $60M FDV.

That is quite achievable.

Conclusion

The valuation is fair given the assumptions of users etc., especially considering the max sell pressure assumptions used to calculate above. If Nebulus achieves the projected user quantities and buy pressure, its token should do well even without speculators and with the full VC tranche filled and selling, which is good.

Our only concern is that the token can suffer in the first year if the team liquidates the Foundation or Treasury tokens in any sizeable capacity without pushing marketing campaigns first, which will churn many users and any speculative brand value Nebulus Finance could build up.

Users quantities and assumptions can change, but the fundamental amount of sell pressure will not. Marketing the project and ensuring there is strong speculative demand for the token as a reflection of how well the protocol is performing is key here.

That said, overall, fair valuation paired with healthy emissions.

Final Thoughts

Nebulus completely overhauled its token utility and economic policies, which will facilitate a substantially greater amount of buy pressure and greatly reduce selling. The emissions are much better, notably due to the cap as a function of buybacks, and the valuation reduced by 5x to $60M FDV helps a lot. If the team doesnʼt sell Foundation or Treasury tokens, the token should not have a reason to perform poorly assuming the user quantity projections are attained.

Recommendations

Consider increasing the value of benefits for membership tiers.

Increase $AUM emissions for AT Stakers to 0.75 and 1.25 for 3 and 6 month lock terms.