Binance Alpha Isn't Free Marketing - It's a Trap

Aug 24, 2025

Every founder dreams of launching on Binance. But that dream can quickly turn into a disaster. Before you rush to chase that spotlight, it is crucial to understand how Binance Alpha and Launchpool really work and why they are likely to hurt your token launch instead of helping it.

What is Binance Alpha and Launchpool?

Binance Alpha gives featured projects early exposure through a Quick Buy option or an airdrop. This allows users to buy tokens at a discount before the official launch or receive free tokens. Binance says this is a quick path to a Binance spot listing if key performance indicators are met.

Binance Launchpool lets crypto holders earn new tokens by locking some of their existing assets, like BNB or other supported tokens. This process is free, and users get new project tokens in exchange for locking their assets.

How does Binance choose projects?

Binance selects projects based on community engagement, such as high social media activity and positive sentiment, market alignment with emerging trends and narratives, and growth potential, focusing on tokens with speculative upside. The exact selection method is not publicly disclosed but uses internal insights and observation lists.

The Alpha Points System

Introduced in May 2025, this system limits how much users can participate in Alpha sales and airdrops. Points are earned daily based on how much a user holds on Binance:

Holding between 100 and 999 dollars earns 1 point per day

Between 1,000 and 9,999 dollars earns 2 points per day

Between 10,000 and 99,999 dollars earns 3 points per day

Over 100,000 dollars earns 4 points per day Users also earn points based on how many Alpha tokens they buy. Selling tokens does not affect points. Points expire after 15 days and are only used when users confirm participation in sales or claim airdrops.

Why Binance Alpha and Launchpool is a death sentence.

Tokens listed through Binance Alpha have all tokens unlocked at once. Binance often asks for four to ten percent of the total supply, which creates huge immediate sell pressure.

Binance can pressure projects to change their vesting schedules just before launch, causing panic and fear among investors.

Projects with the right connections can pay one hundred thousand dollars to buy their way into Binance Alpha.

Many users on these platforms are not real community members but bots or people with multiple accounts, which inflates engagement and misleads projects about real demand.

In short, Binance uses projects to extract value, while startups suffer from volatility, loss of investor trust, and community fragmentation.

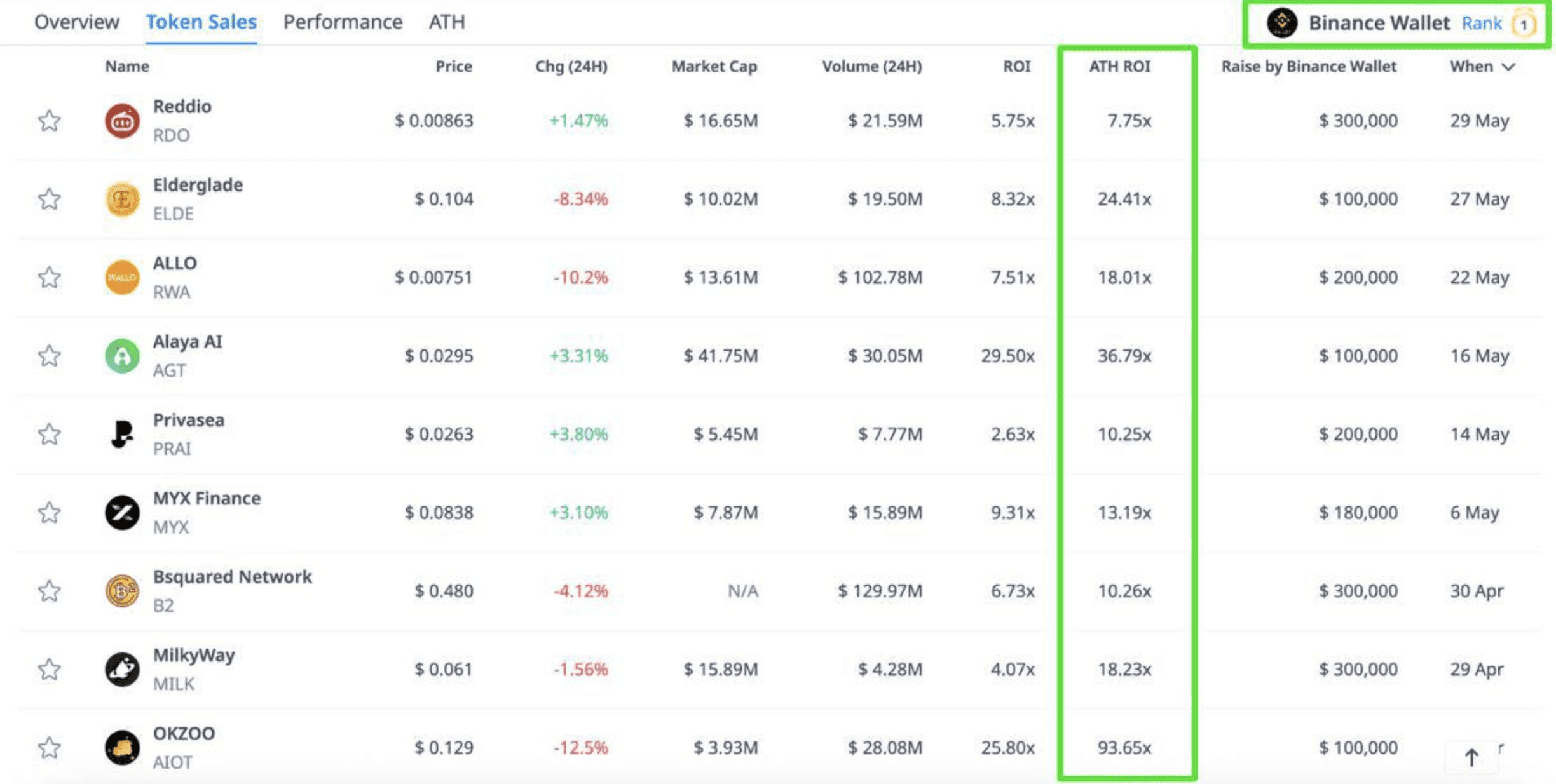

Lets look at some projects that listed on Binance Alpha/Launchpool

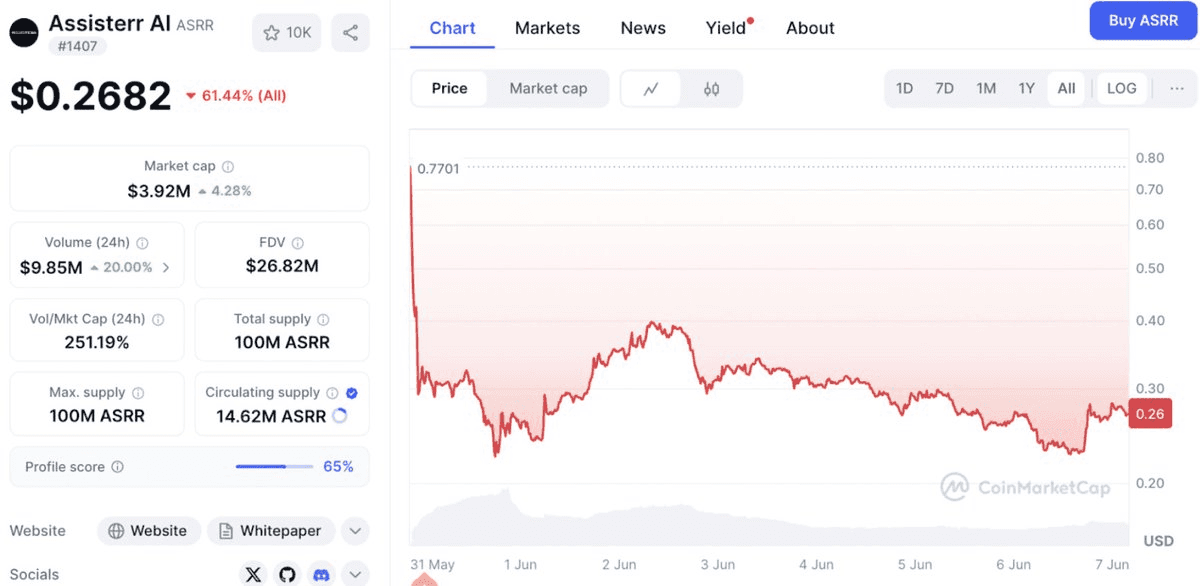

Assister AI

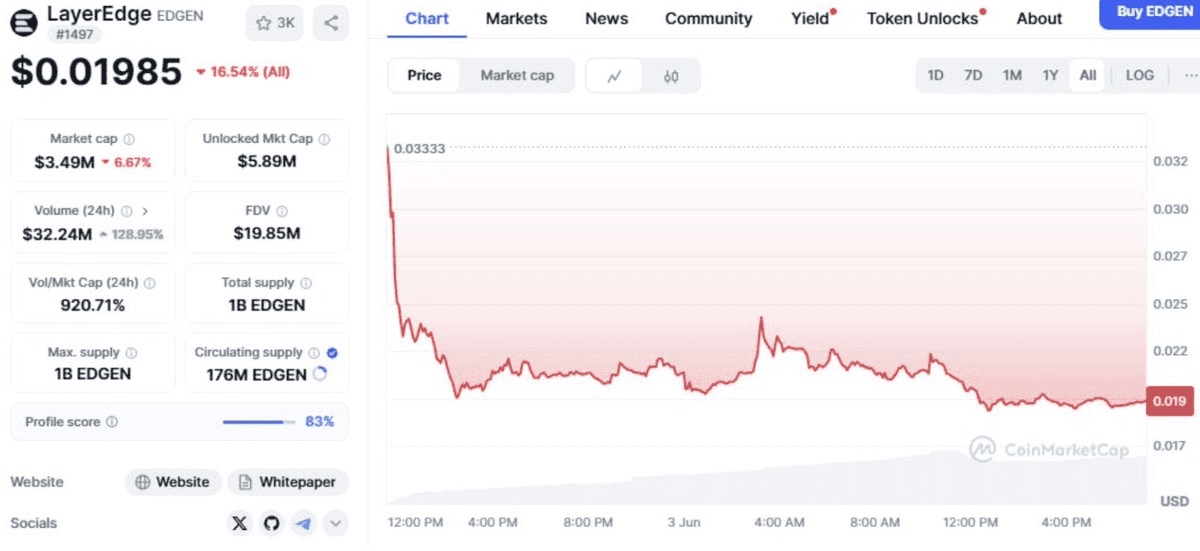

Layer Edge

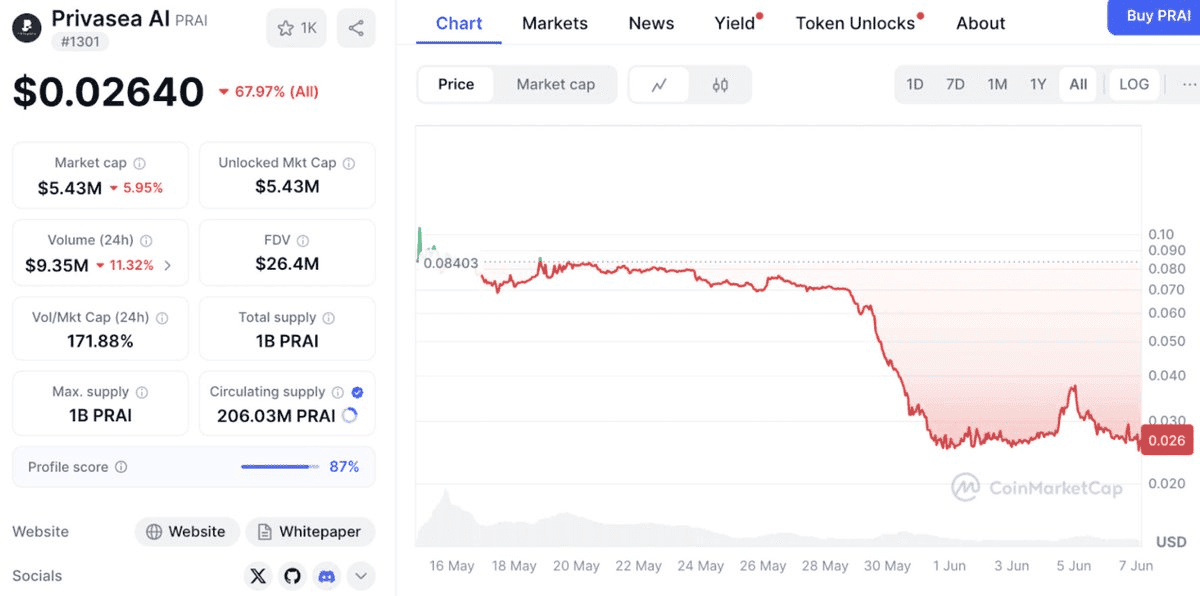

Privasea

Gunzilla

How Binance Changes The Narrative?

Take Privasea for example. Its all-time high return on investment was over 10x, yet the token is down more than sixty percent from launch. This happened because Binance Alpha listed tokens at a $10M valuation, while the official launch valuation was $80M. Early Binance Alpha participants won, but retail investors, VCs, and the community lost out.

What should startups do instead?

Do not overspend chasing listings. Focus on building your product, growing your community, and increasing real trading volume first. If your project gains genuine traction, Binance will notice and approach you. Do not let big players pressure you into unfavorable terms. Your strongest asset is a loyal and engaged community.

Conclusion

Binance Alpha might seem like a golden ticket, but it often sets startups up for a tough battle. Understanding how the platform works and its pitfalls can save you from costly mistakes. Focus on sustainable growth, community building, and product development. The listings will come naturally when the time is right.

How it works

It gives projects a pre-listing spotlight and a quick buy option in early stages, giving them larger reach

“Quick Buy” - Users can find these projects specifically under the “Alpha” tab on the Binance wallet app and buy the tokens with stablecoins, through an optimized swap feature that allows higher successful transaction rate and better prices. In contrast to other Binance listings, users don’t require BNB to participate.

Still, there is no guarantee that the tokens are listed on Binance.

Binance Alpha 2.0: same thing, but the “Alpha” sales are through Binance Exchange instead of Wallet.

Requirements/Selection

Based on community interest, market trend alignment, and growth potential. Projects are “curated” using Binance’s advanced insights and an observation list.

While the exact curation process is not disclosed, the main weights for selection are:

High community engagement and sentiment. which may be done through social media

Emerging market narratives. They focus on tokens within new narratives or trends, which means they go for projects that merely have potential for speculative buys

Alpha Points System

Just introduced, May 13, 2025

Consumption mechanism to limit users’ eligibility for participation in Alpha sales or airdrops. Users spend points when they confirm to participate in an Alpha TGE or claim an Alpha airdrop

Alpha Points calculation is based on activity:

Balance: total amount of assets a user holds in Binance (including Wallet, Alpha, Spot)

$100–$999 = 1 point/day

$1K–$9.9K = 2/day

$10K–$99.9K = 3/day

$100K+ = 4/day

Volume Points: How much Alpha tokens a user buys (selling doesn’t affect points)

$2 = 1 pt

$4 = 2 pts

$8 = 3 pts

…

Amount bought doubles = +1 pt each step

Alpha Points expire after 15 days, and are only spent when a user confirms to participate in a sale or airdrop