Discussions

Nov 24, 2023

The 4D DeFi Paradigm

What is DeFi?

Decentralised Finance, or DeFi, is a narrative in the Web3 space that encompasses companies that focus on decentralising entities that facilitate financial activities or instruments: borrowing & lending, trading, derivatives (from futures to strip bonds), and everything in-between.

Some examples of traditional entities and their DeFi counterparts:

Banks (borrowing & lending) → MakerDAO

Banks (deposit & earn) → Lido Finance

Foreign Exchange Bureau → Uniswap

Exchanges → GMX

Government (strip bonds) → Pendle Finance

That all makes sense. You take out the middle man and create a trustless, and sometimes overcollateralized, system where anyone from around the globe can participate in financial activities.

But this article wasn’t written to explain what DeFi is. It’s a story about how I discovered a new paradigm.

It all started with my issue with the notion of yield farming…

What is yield farming?

It’s the idea of staking or lending your assets to earn yield. That just sounds like a deposit to me, and I wouldn’t personally call that as “farming”.

What I’m referring to as ‘yield farming’ is the idea of recollateralizing debt to earn more yield (this is generally what people refer to when they talk about their “yield farming strategies”). Here’s an example of how it works:

I buy 1 $ETH.

I stake 1 $ETH on Lido Finance, and get $stETH (1:1 ratio)

I take $stETH and deposit it as collateral on MakerDAO, and cash out $DAI

Repeat steps 1-3

Of course, MakerDAO is overcollateralized, so I can’t repeat steps 1-3 indefinitely. But, let’s assume I start with 1 ETH, 1 ETH is $2k, and for every ETH I deposit I can withdraw 70% in $DAI. What do we get?

$2k (ETH) stake on Lido, and get $2k (stETH).

Use $2k (stETH) as collateral on MakerDAO; $1,400 (DAI) withdrawn.

I buy 0.7 ETH and stake it on Lido, and get $1.4k (stETH).

Use $1.4k (stETH) as collateral on MakerDAO; $980 (DAI) withdrawn.

I buy 0.49 ETH and stake it on Lido, and get $980 (stETH).

Use $980 (stETH) as collateral on MakerDAO; $686 (DAI) withdrawn.

I buy 0.33 ETH and stake it on Lido.

Let’s say I stop there.

I go from earning yield on Lido from $2,000 worth of ETH, to $5,066.

To be frank, this bothers me. Sure, my interest payments are larger, but so is my yield.

How is that possible?

Isn’t this just a massive pyramid scam?

Where does this extra value come from?

How have I just created money?

Me, when thinking about DeFi, until 21.10.2023

These questions kept circling in my mind unanswered. But our brains are interesting - whenever we don’t understand something, we reject it. So, logically, I rejected the notion of yield farming and by extension a massive part of DeFi. To me, it was a massive scam that nobody could explain.

That is, until one day, it all clicked.

What happened?

I looked at history.

Traditional Finance

‘Crypto’ isn’t necessarily innovative. The technology, distributed ledger technology (DLT), is new of course, but crypto isn’t - the vast majority of crypto is a decentralised version of something from TradFi.

Technically, crypto is short for cryptography, or more recently cryptocurrency, but in reality most people use it to describe the industry where companies utilise DLT to create a new era of decentralisation and user sovereignty. DLT on the other hand - blockchain, hashgraph, etc. - is simply the “software” (or maybe firmware?) that allows decentralisation to happen.

Crypto is more transparent, secure, and faster, but most of it isn’t new, per se. Therefore, yield farming must exist in the traditional finance space as well. And so it does:

I buy a house.

I rent it out to earn rental income.

I go to the bank and use that house as collateral to take out a loan.

Repeat steps 1-3.

Sure, the more debt I have, the lower my credit rating, and the less money I’ll be able to cash out each time. But, to not retype the exact same example as with ETH above, you get where I’m going with this - I can go from 1 house earning me rent to 2+ with the exact same starting capital.

The same questions bothered me… How is that possible? Where is the value coming from?

But, with this example, something clicked. Although renting houses and staking ETH both have inherent value, thinking specifically about houses caused a different neuron to fire in my brain.

Collateralizing debt is a 4D concept

On one hand, I was thinking about recollateralizing houses to “yield farm”. On the other hand, I also want to buy a house to start renting it out - although it can only happen in the future once I have more capital, I’ve started planning how to do it.

…in the future…

The neuron in my brain has fired.

See, what bugged me this entire time is the first law of thermodynamics, which states, “Energy cannot be created or destroyed." You cannot create extra yield for free. It doesn’t make sense. However, I realised that although energy cannot be created or destroyed, it, theoretically, can be brought from the future.

The idea of debt is a 4D phenomenon.

It utilises the time dimension to increase the amount of energy in the present, not by creating energy, but simply bringing it in from elsewhere.

What I mean is this:

Sure, I can wait for my first house, or initial staked ETH, to earn me all of my yield, then use that yield to buy the second house, or more ETH, then wait some more, then buy some more, then wait some more…

Or, alternatively, I can transcend time for a small cost of the delta between the present value of my collateral and the value of what I can borrow against it (i.e: $2k ETH collateral gets me $1,400 DAI), and start to earn yield from my future collateral, now.

Thinking about debt like this even makes the idea of the US government being $33Tn in debt comprehensible - they are taking value from the future to bring it back to the present, and they keep going further and further into the future to do so.

Now, of course, transcending time isn’t without its problems. What happens when the bubble bursts? All that value is sent back into the future, where it belongs.

In a similar fashion to every time-travel movie, the more you mess with time, the more unstable things become - the latest occurrence of the “space-time continuum” breaking was the 2008 financial crash, after which we faced years of poor economies (to balance the scales again).

Does debt always need to lead to a crash?

Not necessarily. By borrowing from the future, all we’re doing is accelerating time - i.e. if I have $100 today, but I collateralise that and borrow $50, as long as I can create more value with that $50 to return it + interest to be able to withdraw my $100, all I’ve done is accelerated the time it would’ve taken me to achieve whatever I needed that $50 for.

As long as my total value created ≥ the value of today + tomorrow, I should be fine. I’m not a physicist, but that seems to be a reasonable assumption.

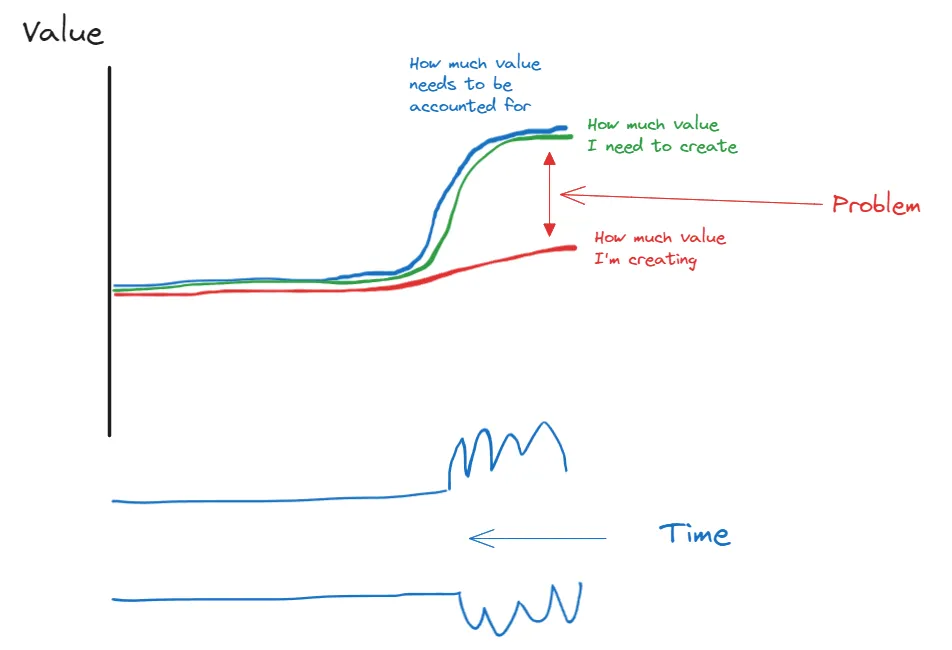

The problem arises when I fail to create that extra value to account for not only today, but also tomorrow, as shown on the excellently drawn diagram below; I start defaulting on my payments, keep borrowing more, and the debt grows more unstable.

As you compress time, the total potential value in the present increases

I digress. My point is this:

DeFi, or more specifically yield farming, makes complete sense.

Tokenomics Consulting Services

The difference between a token that thrives and one that collapses is almost always in the design. Simplicity Group's tokenomics consulting services cover everything from supply modelling to vesting strategy — get in touch if you want expert eyes on your token economy.